Warner, Crapo, Adeyemo Applaud $step one Billion inside Put Requirements to possess Minority & People Lenders Press announcements

Articles

Most other government companies along with serve as the key government executives out of industrial banking institutions; any office of the Comptroller of one’s Currency supervises federal banks, and the Government Deposit Insurance Company supervises state financial institutions that are maybe not members of the new Government Set-aside Program. At the time of December 31, 2022, the former Signature Financial got overall deposits away from $88.six billion and you will full possessions of $110.cuatro billion. Your order which have Flagstar Lender, Letter.A good., provided the acquisition of about $38.cuatro billion from Signature Bridge Bank’s assets, along with finance out of $12.9 billion purchased at a savings away from $2.7 billion. Around $sixty billion within the financing will stay on the receivership to possess later on feeling by the FDIC. Concurrently, the new FDIC acquired security appreciate rights in the Ny People Bancorp, Inc., well-known inventory having a possible property value around $3 hundred million.

Raging, Petulant, Contradictory: Simple tips to Interpret Trump’s Middle eastern countries February Madness

More brief-label interest increases, together with expanded asset maturities will get still boost unrealized loss for the securities and you may apply to financial balance sheets inside the coming household. A significant number of the uninsured depositors in the SVB and Signature Financial had been small and typical-size of companies. Consequently, there are inquiries you to loss to these depositors do place them at risk of not being able to make payroll and you may pay providers. Additionally, on the liquidity away from financial organizations after that quicker and their investment costs increased, banking organizations can become considerably less happy to provide in order to companies and houses. Such outcomes do sign up to weaker economic overall performance, next destroy economic locations, and also have most other matter side effects. Including Silvergate Lender, Signature Bank got as well as centered a life threatening portion of the organization design to your digital investment industry.

- While, to find no deposit added bonus codes on the online casino web sites having in public areas readily available offers, you should browse the bonus description on the website.

- The deal helps Saudi Arabia’s Sight 2030 — a monetary diversification method aimed at reducing reliance upon petroleum earnings because of the expanding low-petroleum exports and you will building regional trade associations, along with which have Egypt.

- The new Reserve Banks’ merchandising functions were distributing currency and you may coin, collecting inspections, electronically mobile financing because of FedACH (the brand new Federal Reserve’s automatic clearing household system), and you can while it began with 2023, facilitating instantaneous repayments with the FedNow service.

- Control times echo the period of time from when the field tasks are over so you can if the statement of test is sent to the financial (otherwise Consumer Monetary Defense Bureau (CFPB)/State Financial Service).

USF Sum Foundation Dips To 32.8 % For Next One-fourth Away from 2024

It memorandum studies U.S. economic sanctions and you will anti-currency laundering (AML) improvements in the 2024 while offering a perspective for 2025. Saudi Arabia’s Ministry out of Money provided 789 certificates to help you Egyptian organizations within the the next one-fourth away from 2024 — a good 71 % increase regarding the same several months inside 2023 — making the nation the major individual of your own it allows regarding the Empire. The fresh agreement falls under a number of financial sale closed while in the Saudi Crown Prince Mohammed bin Salman’s Oct visit to the fresh North African nation, which also based the fresh Saudi-Egyptian Supreme Control Council. This was mainly motivated because of the shipment of its 34.52 % share inside the Almarai so you can shareholders, ultimately causing an online acquire away from SR11.step 3 billion.

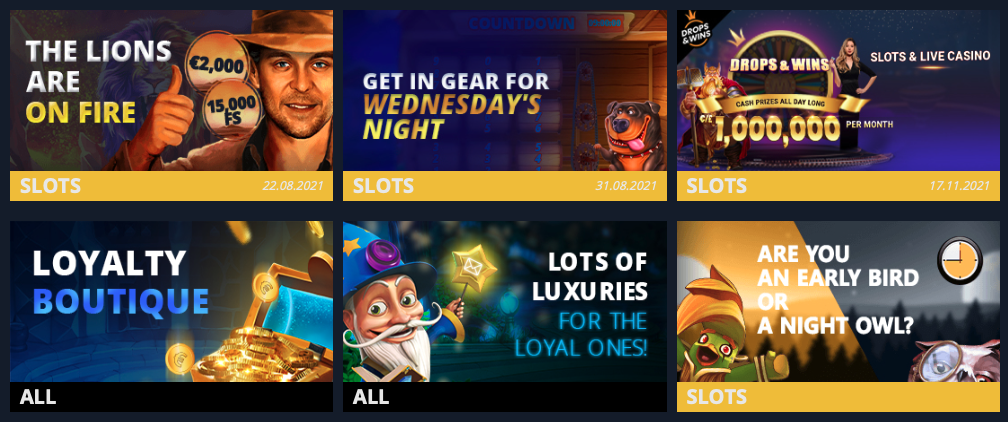

Definitely, all types of casino incentives feature pitfalls, as well as no-deposit of them. To provide a thorough evaluation, we now have considered the benefits and you will cons of no-deposit bonuses in the Canada. This type of banks is actually big enough for consumers which have high deposits but nonetheless small sufficient which they might possibly be permitted to falter. There’s an evident rise in the interest rate of growth of these types of deposits performing once 2018, a situation that’s likely a result of the newest legal transform revealed a lot more than. Far more striking, but not, ‘s the 20% rise in 2023 for banking institutions which have assets between $1 billion and $100 billion.

Longer away from qualifications are an exception, however, there can be circumstances whenever such bonuses are valid to possess to 7 otherwise 30 days. Generally, just after registering a merchant account, a no-deposit offer was available for seven days. These offers can be good indefinitely, even after you have signed up.

The newest gambling establishment is actually part of the newest Casino Perks Category, meaning you should use mrbetlogin.com company web site any commitment items gathered at this site to the some other CR brand name website. “Provided what we’ve seen in the final six months, all of the banking companies were forced to increase deposit rates to keep competitive,” Curotto advised Observer, talking about the brand new Federal Set-aside’s continued interest rate nature hikes since the last year. The new challenging interest in Apple’s the new banking equipment stands in the stark evaluate to customers’ waning rely upon the fresh You.S. bank system in the middle of the newest constant chaos away from regional banking companies. Benefits say Apple’s achievements results from both the good brand feeling and you may a sensible relationship which have an established financial during the correct date. For the Monday the fresh Finest Courtroom overlooked the newest interest because of the businessman Adi Keizman against the choice of the section courtroom obligating him in order to pay 6 million shekels ($step one.six million) in order to artwork dealer and you can websites business owner Muly Litvak. The brand new Board away from Directors of CIBC assessed so it pr release past so you can they are granted.

No-deposit Incentive of your own Day: Current March 2025

Trump’s courtroom party tend to inquire the new Best Court to supply an excellent stick to trial legal proceeding up until they things a good governing on the congestion topic, which governing you are going to become because the later as the last week of June if the Supreme Courtroom’s term wraps. If you take up an appeal by implicated Jan. 6 Capitol rioter Joseph W. Fischer, the new court you are going to undo the most significant federal unlawful charges Trump is actually up against to own his attempt to subvert democracy. Unique guidance Jack Smith’s efforts to hang Donald Trump fully guilty of seeking overturn the outcomes of your own 2020 presidential election is up against a great fresh test — all the due to a single-range buy in the Best Judge.

Donald Trump’s chaotic approach have kept inventory places tumbling and made lots of anxiety one of marketplace one to trust change to the United states. It content have helped a huge number of somebody stop holding for an agent. But not, more six,000 people every day nevertheless like to hold off to dicuss to help you an agent regarding the Act. These phone calls, and individuals and you may visits inside regional offices, continues to improve along the future weeks and you can months. If a person has received their premiums subtracted using their CSRS annuity, after which enforce for Societal Defense professionals, SSA will state anyone one to their superior tend to today be subtracted using their month-to-month Social Protection benefits. Should your people prepaid their premium on the Locations to have Medicare & Medicaid Characteristics, and you may SSA tells him or her you to definitely the advanced have a tendency to today be subtracted from their month-to-month Public Shelter professionals, they’ll receive any relevant reimburse.

Realization On the six Attention Position

As the previously noted, the industry’s unrealized loss on the ties was $620 billion as of December 29, 2022, and you will flames transformation inspired by deposit outflows could have subsequent disheartened costs and you will impaired security. A common bond between the collapse of Silvergate Lender as well as the failure of SVB is the newest buildup away from loss in the banking institutions’ ties profiles. From the aftermath of your own pandemic, because the rates of interest remained during the near-no, of numerous organizations replied from the “reaching to possess produce” because of investments inside extended-identity assets, while others reduced to your-equilibrium piece liquidity – dollars, federal finance–to improve total productivity on the generating possessions and maintain online interest margins. This type of choices lead to another preferred theme in the these types of organizations – increased exposure to interest-rates chance, and therefore set dormant because the unrealized loss for the majority of financial institutions since the cost easily flower within the last season. When Silvergate Lender and you may SVB knowledgeable easily speeding up liquidity requires, they sold securities at a loss. The new today know losings created both exchangeability and you may funding chance to have those individuals organizations, leading to a personal-liquidation and you will incapacity.

This is the rate of interest one banking companies charges both to possess at once fund away from federal money, do you know the supplies held because of the banking companies during the Given. It rate is largely determined by the marketplace which can be not clearly required because of the Fed. The new Given therefore attempts to fall into line the brand new energetic federal fund speed on the directed rates, mainly because of the changing its IORB rates.92 The newest Government Put aside Program constantly changes the brand new government fund price target by 0.25% otherwise 0.50% at a time.

My personal Membership

Given the will cost you in it, really the only cause to utilize mutual deposits would be to effortlessly boost insured places. The newest column entitled “p50” reveals the new carrying away from uninsured dumps of the average lender inside the per proportions class. Far more generally, the new economic climate continues to face extreme drawback risks on the outcomes of rising cost of living, rising market interest levels, and continuing geopolitical uncertainties. Borrowing from the bank top quality and you may profitability could possibly get deteriorate because of these dangers, potentially ultimately causing stronger mortgage underwriting, slower loan development, highest supply costs, and you can exchangeability limitations.

Comments

Comments are closed.