Why Basic Republic Financial Is In the Genuine Trouble Today

Just like the failure regarding SVB Financial and Signature Bank, additionally the pressed acquisition of Borrowing Suisse, there are some cues the banking business are stabilization, though it continues to be too soon to share with. Yet not, you to definitely financial that will continue to battle try Earliest Republic (NYSE: FRC) , and therefore watched its shares whip-up and down due to the fact market attempts to control new quickly developing condition. Earliest Republic knowledgeable raised put outflows and you will borrowing downgrades on score businesses.

Just like the bank makes numerous tries to attempt to coast upwards depend on — and you will acquired a giant deposit injections off particular high U.S. finance companies — I believe Basic Republic might possibly be during the actual issues today. Is as to the reasons.

Trying to plug up First Republic’s deposit outflows

Such as SVB, Earliest Republic got an abundance of uninsured dumps. It absolutely was also providing large-net-worthy of some body and you can companies that you’ll eliminate deposits during the an increased rate than almost every other more traditional local financial institutions. Basic Republic including got on $cuatro.8 mil off unrealized losses within its stored-to-maturity (HTM) thread collection, having not become subtracted on bank’s collateral yet. The lending company had on the $a dozen.8 million out-of concrete popular equity at the end of 2022.

Various mass media outlets for instance the Wall structure Path Record claim that Very first Republic got from the $70 mil off put outflows, hence equates to throughout the 40% of the full put feet. Certain analysts put the estimate higher still. Earliest Republic’s objective should be to not need to promote its bonds as they trade at a loss to fund deposit outflows given that who eliminate a significant amount of shareholder collateral.

The lending company has been trying to plug the new deposit opening that have higher-costs borrowings. It is quite building the cash standing in order to sit flexible and deal with put volatility. Towards the March 16, Very first Republic reported that it received $30 million out of dumps regarding 11 of your prominent You.S. banks.

What’s more, it said which have a money position out-of $34 mil, excluding the $30 million from deposits it got simply gotten on the highest banking institutions. Anywhere between February 10 and you will February fifteen, First Republic drew borrowings regarding Federal Reserve on the shocking range of ranging from $20 mil and you will $109 mil. These types of quickly borrowings hold an over night rates out-of 4.75%. Basic Republic along with said they had improved short-identity borrowings from the Government Mortgage Bank by the $10 million at a high price of five.09%.

Just how this can stress First Republic’s margin

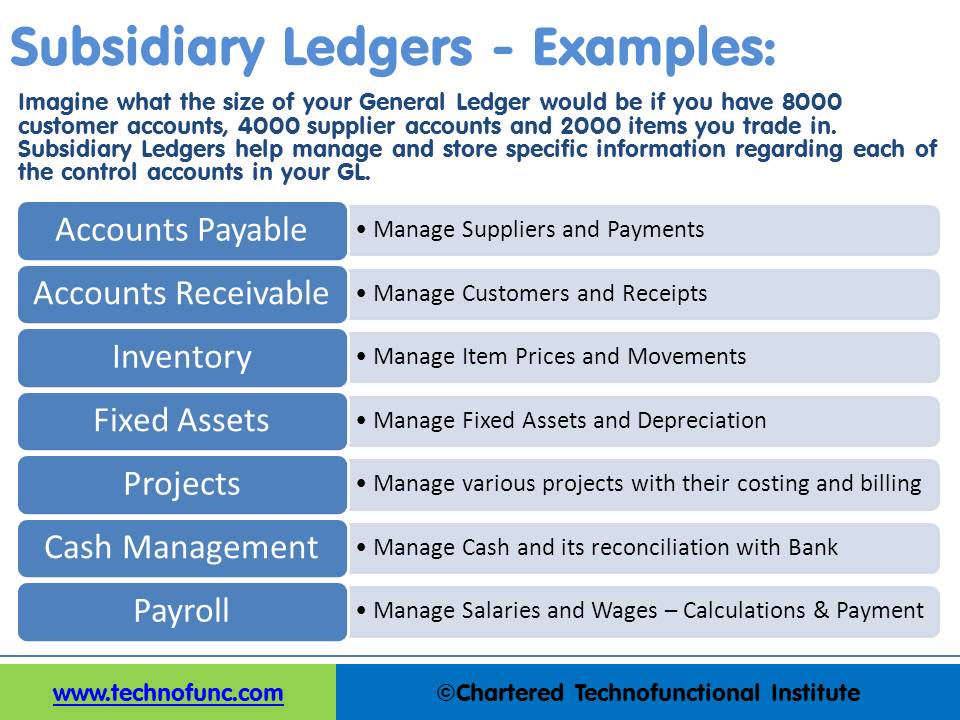

An option metric to view since it makes reference to bank success ‘s the net attract margin (NIM), and therefore essentially looks at the essential difference between exactly what a financial produces on attention-getting property including finance and you may ties, and you will exactly what it will pay on notice-affect liabilities instance places and you will borrowings. Here’s a review of First Republic’s property at the end of 2022.

Very first Republic’s securities publication got a great adjusted yield away from step 3.19%, since bank have a good $ninety-five mil financing publication off mortgage loans yielding 2.89%. More or less 37% of bank’s fund have been plus fixed-price fund at the end of 2022, given that hefty remainder provides crossbreed rates, definition he could be repaired to have anywhere between you to and you may a decade and after that adjust. Therefore, the bank’s focus-making property are not on the better position provided in which wider interest rates and you may bond production is. Today, is a peek at First Republic’s obligations.

The brand new $70 million-plus in outflows provides probably come from the newest bank’s $75 mil from low-interest-influence places, that your bank pays zero appeal towards, otherwise less notice-impact supplies such as for instance checking membership or money markets membership which have lower interest levels. The financial institution has needed to exchange these down-prices loans with $ten million off brief-name borrowings producing more than 5% and many high number from money from brand new Fed’s dismiss window yielding cuatro.75%. The bank is also likely expenses market price of cuatro% otherwise 5% towards $30 mil out of dumps it really gotten in the eleven You.S. financial institutions, and that need certainly to stay static in Basic Republic for approximately four months.

So, since the genuine modeling is quite cutting-edge due to most of the swinging pieces, I believe it’s reasonable to assume one to Earliest Republic’s rates for the desire-impact debts is just about to rise in the 1st quarter off the year and possibly after this current year as well, when you’re its focus-getting assets would not pick the production rise by the almost adequate to counterbalance the grand step in during the investment will cost you. The rise for the asset edge of Very first Republic’s equilibrium layer might end upwards becoming more minimal, offered the mortgage constitution. This will very place a reduction within the Earliest Republic’s close-identity earnings and perhaps lead it to report a large loss, which could consume into the the funding reputation.

Very limited a beneficial options for Very first Republic

According to news accounts, it appears as though Very first Republic has trouble having strategic options, which include looking for a buyer or elevating financial support. As the lender got quite an effective company and you can are an effective quite strong-carrying out inventory usually, Basic Republic happens to be sitting on billions during the unrealized loan losses one to an enthusiastic acquirer would need to deal with.

There have also been reports you to First Republic might look so you’re able to downsize their harmony sheet from the offering specific businesses otherwise fund. But because of the reduced-producing, long-stage characteristics many of their money, the lending company would probably must offer people at a discount or take losses.

Truly the only a cure for the fresh new inventory, about what I’m able to share with, is when it does for some reason rating a lot of the subscribers so you’re able to bring the down-prices deposits returning to the bank, and i have only no idea just how possible that is. I’m not sure when it is hopeless, particularly if the authorities produces some sort of be sure for the places, but I am definitely not probably bank inside it. Provided such near-term pressures therefore the options that bank both becomes ordered at some kind of package rates otherwise really does a very dilutive money increase, I might recommend searching for other payday loans Kentucky potential on banking industry.

ten holds we love much better than Basic Republic BankWhen our very own honor-effective expert people keeps an inventory idea, it can spend to listen. After all, new newsletter he has got focus on for more than ten years, Motley Fool Inventory Coach, enjoys tripled the market industry.*

They simply found whatever they believe will be ten most useful carries having buyers to order today. and you may Basic Republic Lender was not included in this! That is right — they think such 10 carries was in addition to this expenditures.

SVB Economic provides credit and you will banking qualities on Motley Deceive. Bram Berkowitz has no updates in every of your stocks said. The newest Motley Fool have ranks in the and you can advises SVB Economic. This new Motley Deceive provides a good disclosure plan.

Paid Blog post : Content produced by Motley Fool. The world and you can Send wasn’t with it, and material was not assessed before guide.

Comments

Comments are closed.