The fresh new Character from Mediator Battle within the Bodies Interventions: The scenario out-of HARP

Email A buddy

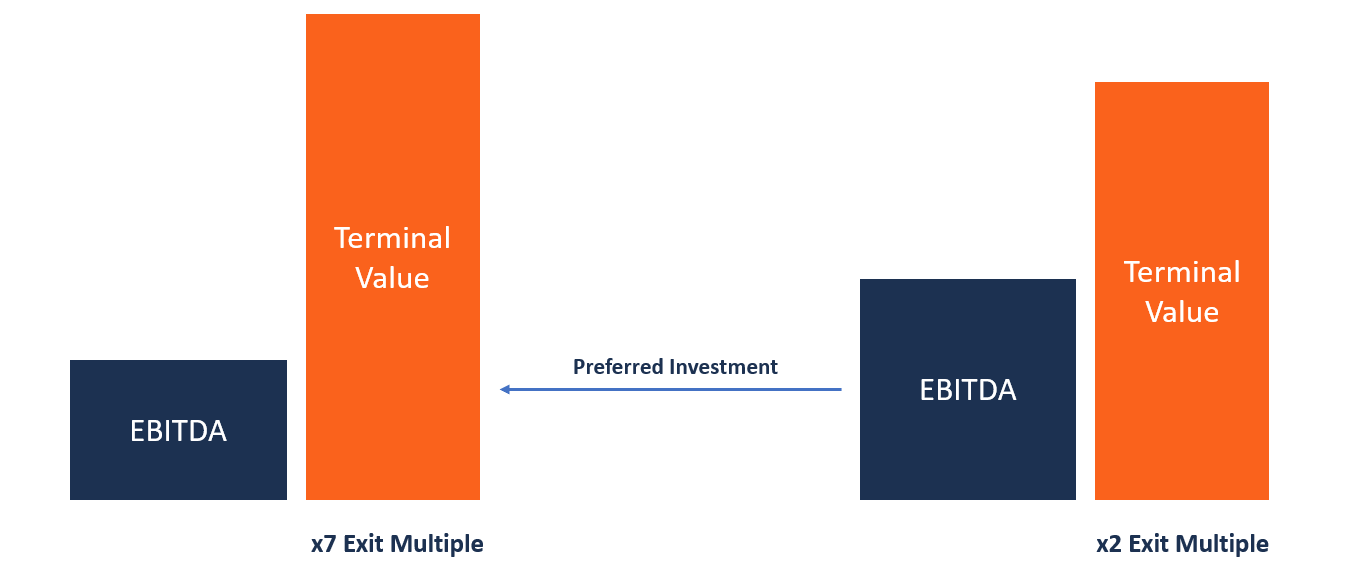

The pace into 30-season traditional mortgage loans decrease throughout six.5 % in 200708 so you can below 5 per cent in 2009. But really a number of the disturb borrowers exactly who could have received big advantages from the fresh new fall-in prices were unable in order to refinance their mortgages at the down prices. The problem is that get rid of inside casing cost got made their loan so you can well worth (LTV) a lot higher and ineligible installment loans online in Kentucky having typical refinancing.

In an effort to let this type of borrowers and reduce home loan default costs, the us government, handling Federal national mortgage association and Freddie Mac, created the Home Reasonable Re-finance Program (HARP). The newest Federal government originally estimated one to as much as 8 mil individuals you certainly will benefit from HARP. Although not, the application had off to a much slower start, refinancing only about 300,000 fund during its first year.

This informative article begins with a conclusion from HARP. After that it covers the conclusions of Agarwal et al. (2015) exactly who give an extensive study away from HARP and you will become familiar with one to cause as to why HARP possess did not surpass very first traditional. The data suggests that since the followed, HARP provided a critical competitive benefit to current servicers more the fresh new lenders for the refinancing upset funds, and therefore led to limited race when you look at the performing HARP in the 1st long time.

HARP qualifications The newest You.S. Treasury therefore the Federal Houses Finance Institution (FHFA), new regulator of authorities-paid people (GSEs), developed the Family Reasonable Refinance Program (HARP) to enhance the fresh new number of individuals exactly who you will definitely refinance its finance. Absent HARP, consumers with an excellent LTV proportion over 80 per cent would not be considered for normal refinancing of its mortgages shortly after 2008. step 1 HARP offered a system of these consumers so you’re able to refinance at the a lower speed. Although not, this option came with one to essential limitation: HARP exists in order to prime antique compliant fund active into the GSEs’ books at the time of .

The decision to limit HARP to help you prime old-fashioned compliant mortgage loans got the end result away from leaving out a few of the most troubled consumers, also people who got out a good subprime, Goodlt-A good, or jumbo mortgage. 2 These funds were generally maybe not permitted become protected by the the GSEs and, hence, were not for the GSEs’ courses.

The explanation for limiting the fresh new finance to people effective on the GSEs’ instructions is the fact that the GSEs currently owned the financing chance during these mortgage loans. Thus, refinancing the current equilibrium on these money during the a lesser speed won’t help the GSEs’ borrowing from the bank chance. Actually, refinancing them during the a lower life expectancy rates create reduce the danger of borrowing losings by making it easier for individuals to stay latest on the fund and get away from standard. not, in the event the program was prolonged to help you funds which were not on the fresh new GSEs’ books, the latest GSEs is guaranteeing fund that they’d no past coverage, which will improve GSEs’ expected losings.

The necessity that fund be antique fund omitted money secured by federal providers for instance the Government Property Management (FHA) and you may Experienced Factors (VA). This type of funds weren’t found in HARP because their credit chance had been borne fully by FHA and you can Va instead of the GSEs.

Cardiovascular system to have Economic Advancement and you can Balances

Latest servicers’ virtue not as much as HARP The theory is that, consumers wishing to re-finance under HARP may go to your financial bank that took part in HARP. The ability to visit any financial authored an essential possible getting competition below HARP ranging from mortgage lenders who would optimize the brand new display of one’s refinancing gains you to definitely decided to go to the latest borrower. However, in the event that individuals was in fact expected to play with their current servicer, you to definitely servicer you certainly will decide if as well as on just what conditions individual individuals you certainly will refinance according to that which was good for the new servicer. 3

Comments

Comments are closed.