What takes place whether your borrower is not able to repay this new financing?

Independent Pointers. Understand Your Debt

We daily offer designed private guidance to individuals just who desire render individual guarantees in favour of others (like household members or family unit members), people, trusts, or notice-treated superannuation fund. You then become a guarantor when you guarantee’ that loan for anyone else.

Your own be sure was a great contractual pledge in order to a financial institution or any other bank that the guarantor often honour the personal debt enforced below a loan agreement otherwise mortgage if the a debtor does not continue the monetary claims.

When you end up being an effective guarantor, you are responsible for trying to repay the loan if the borrower does not get it done. If you are a guarantor and the borrower is unable to pay back the borrowed funds, the lender may take legal action against you. You might be liable for the quantity given from the verify (if or not restricted or unlimited) and possibly for all costs associated with the lending company implementing new be sure.

Due to the fact guarantor you might not always qualify find out of the new borrower’s default in addition to earliest alerts you obtain is when the financial made a call facing you because the guarantor to afford borrower’s obligations.

Guarantors for a mortgage

A great guarantor getting a mortgage allows the newest collateral in their possessions for usage just like the even more cover to your borrower. In lot of of them scenarios, the fresh new guarantor try a family member such as a pops, grandparent, otherwise cousin. In case your debtor is unable to make money into mortgage and you may non-payments, the fresh guarantor will get guilty of and also make these costs.

Minimal versus unlimited pledges

A vow can be minimal, and therefore the fresh new guarantor’s liability gets to a fixed matter otherwise portion of the mortgage, otherwise unlimited, meaning the fresh guarantor might possibly be accountable for the complete home loan. The newest guarantee files tend to establish whether or not the be certain that is limited otherwise perhaps not.

Might you have more than just one or two guarantors?

There clearly was multiple, several guarantors to help you home financing, which means that the brand new verify will be given together and you will severally. Within this circumstance, the lending company can take action up against the guarantors together otherwise severally (i.elizabeth., only 1 guarantor). Severally’ simply means for each guarantor was probably liable for brand new entire mortgage number of the newest be sure.

Generally, you will not manage to promote your own guaranteed property in the place of the fresh new guaranteed mortgage are paid in a choice of area otherwise complete or getting a variety of replace safeguards toward financial.

Certain banks may enables loans for bad credit Tarrant you to pay down new be sure with the earnings of your sales. Such as for example, for those who protected a certain portion of the borrowed funds, you could potentially pay you to number inside bucks to the bank and you will in return, the lending company manage release their be sure and you can launch their mortgage more than your protected property up on payment.

The financial institution also can agree to keep an amount of cash about business in your home since the substitute for the safety in a phrase put account on the name.

Whenever you are offering your residence and buying an alternative you to definitely at the same time, the bank can get allow you to transfer the make certain off to the new possessions. Bear in mind, you’ll most likely be required to done an alternate Guarantor Guidance Certificate.

Separate Guarantor Advice Certificates

The reason for an excellent Guarantor Suggestions Certification (GAC) demonstrates to help you a lender that its customer keeps received independent legal guidance and you will completely knows the brand new legal nature regarding what they’re signing. GACs were introduced in response to help you instances when loans or claims had been booked because individuals or guarantors was in fact located to own not realized what they have been finalizing.

Given that guarantors usually receive absolutely nothing in return for adding on their own in order to financial risk, financial institutions always require which they first get separate legal advice before signing people guarantee data.

- moms and dads providing a good family relations pledge’ be certain that to possess a beneficial newborns home loan

- financing to members of the family trusts

- fund so you can organizations

- fund so you can thinking-handled superannuation loans

It’s very crucial that you find separate legal services whenever you bring a promise for third party, even although you believe the next people commonly complete their repayment obligations.

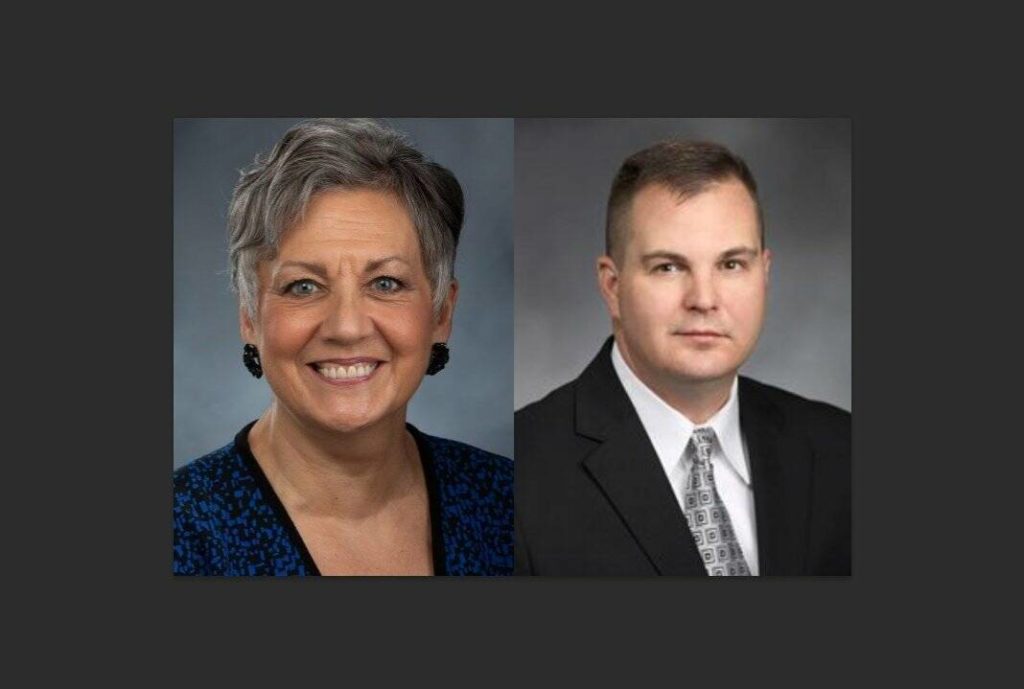

Matti Lamb & Couples offer Verify Guidance Certificates to possess a fixed commission mainly based on every bank’s criterion and requires. The versatile solution implies that advice will likely be given myself at our very own office, or through video clips link.

If you prefer direction, get in touch with one of the lawyers during the [email secure] otherwise call 08 8155 5322 to own specialist legal counsel.

Comments

Comments are closed.