Simply how much financial help are you willing to be prepared to discovered on the NC Domestic Virtue Mortgage system?

Therefore you’re prepared to get a home, but do not can afford to a down-payment. Brand new NC Home Advantage Financial program you will definitely give you the financing you will want to security most of the requisite down-payment. The brand new NC Domestic Advantage Home loan system supplied by brand new NCHFA, will bring financial assistance to homebuyers during the Charlotte or other elements in the New york who want advice about the advance payment and you will settlement costs. In the place of others, this new NC Domestic Advantage Financial isnt limited by areas or city limitations; it can be used statewide.

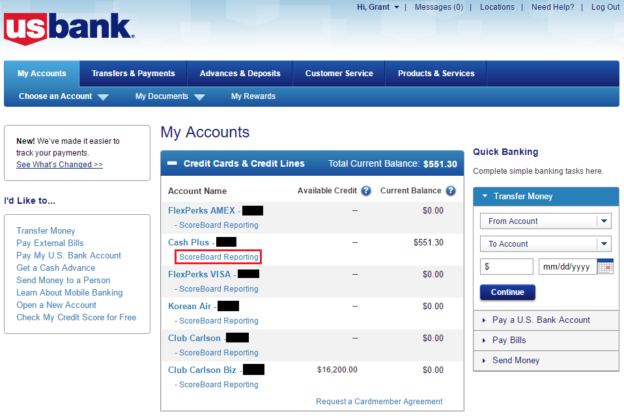

Qualified home buyers is also found doing 5% of your own amount borrowed they qualify for within the financial assistance. That cash applies with the down-payment and you may closure expenses associated with the acquisition of a house.The application must be used in conjunction with a great FHA mortgage or conventional mortgage. Good FHA mortgage needs an effective step three.5% downpayment or 96.5% financing so you’re able to worth (LTV). Very particularly, if your price of the house we should buy was $150,000 and also you qualify to finance the acquisition that have good FHA financing in addition to the NC Family Advantage Mortgage program, you can meet the requirements for as much as $7,237 for the guidelines:

The required advance payment to invest in one to house with a great FHA financing might be $150,000 x 3.5%= $5,250. As well as the direction would safety all your downpayment requirement.

Totally free money so you can own a property

NCHFA just means installment with the down-payment guidelines for many who sell, re-finance otherwise import your house just before year 15 of the mortgage. To your Family Virtue Financial program, this new down-payment assistance is forgiven at a level out-of 20% per year once you’ve lived in your house to possess ten many years, and you can totally forgiven immediately after 15 years. So fundamentally, if you remain in our home you purchased into the help of one’s NC Household Virtue Home loan program, the five% you received in the assistance is Free currency!

Advantages of your house Virtue Mortgage program

The home Virtue Mortgage program has some professionals more other off percentage advice software available in brand new Charlotte area. Selecting the downpayment recommendations system that best suits your real property and you may financial needs would be overwhelming. A substantial knowledge of the individuals apps is key to cause them to become try to your own virtue. You should not exclusively believe in their bank to guide you through the method and must get the help of a realtor so you’re able to. Brand new Real estate professionals in the Foundation Realty Carolinas provides extensive sense dealing with first time home buyers and you can progress people, and having downpayment recommendations programs. All of our sense will assist you to prevent well-known rather than therefore prominent downfalls low-educated home buyers and you can agents build while using the advance payment advice software.

- Deals with FHA fund which offer a great deal more flexible qualifying terminology that old-fashioned financing

- Big DTI (loans so you can income ratio) that allows homebuyers to help you obtain over others. The maximum deductible DTI is 41%.

- Can be used any place in North carolina. Most down-payment guidelines apps are restricted to often certain neighborhoods, area, town limitations or quantity of residential property you to definitely qualify. Toward NC Household Virtue Financial program, tens of thousands of residential property already on the market qualify.

Qualification toward NC Domestic Advantage Home loan

To help you qualify for aaa loans Byers the new NC Household Virtue Home loan system, home buyers plus the property as financed need meet particular standards and you may recommendations. Below are the main criteria:

- You must be to shop for a different otherwise established domestic within the Northern Carolina

- Youre a first-day otherwise flow-right up customer

- Your entertain the property inside 60 days of shopping for it

- The yearly revenues doesn’t meet or exceed $87,five-hundred

- You are making an application for a government covered mortgage particularly FHA, USDA or Virtual assistant financing owing to an acting Financial, or a conventional financing, and you can meet with the sales speed limitations of the financing variety of. One restrict to have Mecklenburg and you will surround areas try $271,050 having an individual quarters that have FHA financing

- You are a legal resident of your United states

- Your credit score was 640 or higher (660 rating getting are available residential property).

Comments

Comments are closed.