How much financing ought i be eligible for?

Illustration: have a look at desk lower than to learn exactly how different facts influence the fresh eligibility to help you avail of a mortgage:

- Years standards: Your actual age is the greatest determinant noticed by the finance companies when you’re deciding your residence mortgage eligibility. Extremely banking institutions reduce financial tenure for the applicant’s senior years many years. Hence, when compared to more youthful somebody, it is hard for seniors nearing later years to acquire a good longer-identity mortgage except if he has got proof an everyday income supply.

- CIBIL otherwise credit history: Your own CIBIL or credit rating is yet another crucial determinant based on that the bank analyzes your loan fees feature. The financing get is actually good around three-digit matter which is basically a listing of your credit report. It’s always a good option to evaluate the minimum borrowing get for home financing prior to examining your house financing eligibility because the a woeful credit rating leads to highest interest levels or mortgage rejection.

- Earnings balance: The main cause of income and you can occupations balances having salaried men and women are considered from the loan providers whenever approving loan requests. Likewise, self-working someone shall be entitled to that loan if they show he’s a steady income source. Why don’t we appreciate this which have an illustration.

Illustration: investigate desk below to learn how different items influence the fresh new qualification so you’re able to avail of home financing:

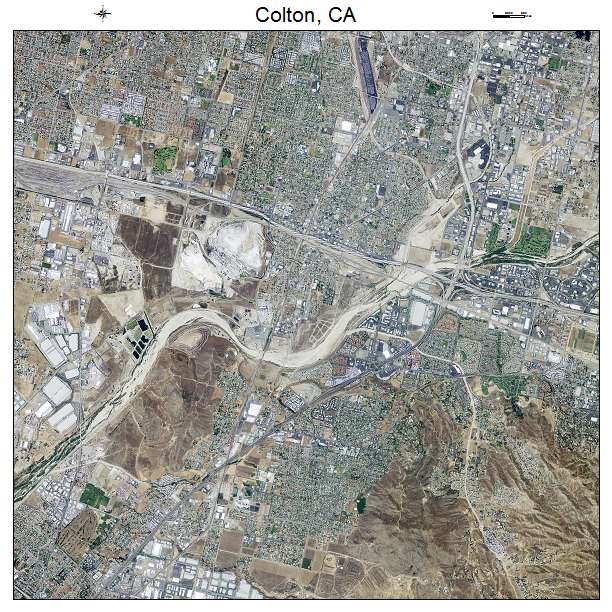

- Property details: The age (go out or perhaps the seasons regarding build) as well as the precise location of the possessions you’ve selected to get are among the severe items one banking institutions can get believe when you find yourself granting your home loan. Such items act as a secure deposit against that you’ll avail the home mortgage. Also, there is certainly a go that the mortgage software carry out get refused, if your tenure are longer than the rest preserving years of the property. Therefore, finance companies always make a variety of technology and you can court data from the house prior to sanctioning the house mortgage.

- Loan-to-worth (LTV): The borrowed funds-to-worth ratio otherwise LTV in home loan refers to the proportion involving the mortgage amount while the appraised value of the newest possessions. Within the effortless terminology it is one of the chance assessments gadgets or actions used by banks to minimize the possibilities of defaults. It is basically the part of the property value that good lender can provide in order to a home buyer.

- Debt-to-money ratio: Debt-to-money ratio relates to a review device thought because of the financial institutions to measure your house loan applicant’s installment potential. It is calculated as the a portion by the isolating the house financing applicant’s net monthly debt costs from the their month-to-month earnings.

To buy a home try an aspiration of numerous hope to, but the fear of financial setbacks can overshadow the fresh new excitement. Including questions are. This is where the home loan eligibility calculator becomes crucial.

This informative guide delves deep for the electricity of this tool, providing wisdom so you can avoid financial issues, and you can reassuringly circulate nearer to possessing your ideal home.

Inclusion to Financial Qualification

To shop for a property the most high economic behavior https://paydayloanalabama.com/putnam/ an individual may make inside their lifetime. For many individuals, it’s not possible to pick a home outright, that is why many look to mortgage brokers otherwise mortgage loans.

Beforehand your own trip on the homeownership, it’s essential to see the notion of home loan qualifications. It does not only determine if you can get that loan as well as just how much you could borrow.

Financial qualification refers to the conditions and requirements according to and this a financial institution decides if an individual qualifies to have an excellent home loan. Its a means to possess loan providers to evaluate the danger of this financing money to help you a borrower.

Comments

Comments are closed.