Securities vs Carries Overview, Analogy, Advantages Drawbacks

Services referenced are given and you may sold only by the rightly designated and signed up organizations and you can financial advisors and you will professionals. Solely those representatives having Coach within label or just who otherwise divulge its status since the a coach out of NMWMC is actually credentialed while the NMWMC agencies to include investment advisory characteristics. This type of differing threats and you can efficiency let investors favor how much of for every to find — also referred to as building a good investment collection. Based on Brett Koeppel, an authorized financial planner inside the Buffalo, Nyc, stocks and securities features line of spots that may produce the greatest overall performance once they complement both.

The new founder can visit some people and you may mountain the new achievements away from his business to the people to help you boost currency on the second lemonade stand. Stock prices were highly erratic, and you may inventory traders often get rid of (otherwise get) a serious portion of their internet really worth in this a point of months (if you don’t occasions). Compared, the us stock-exchange is back next to 10% per year over the years (even though there is no ensure that this can remain forever). Bonds will pay attention a year, twice yearly, every quarter, if you don’t monthly. There are also very-called zero-coupon ties, and this shell out no desire whatsoever.

Stocks

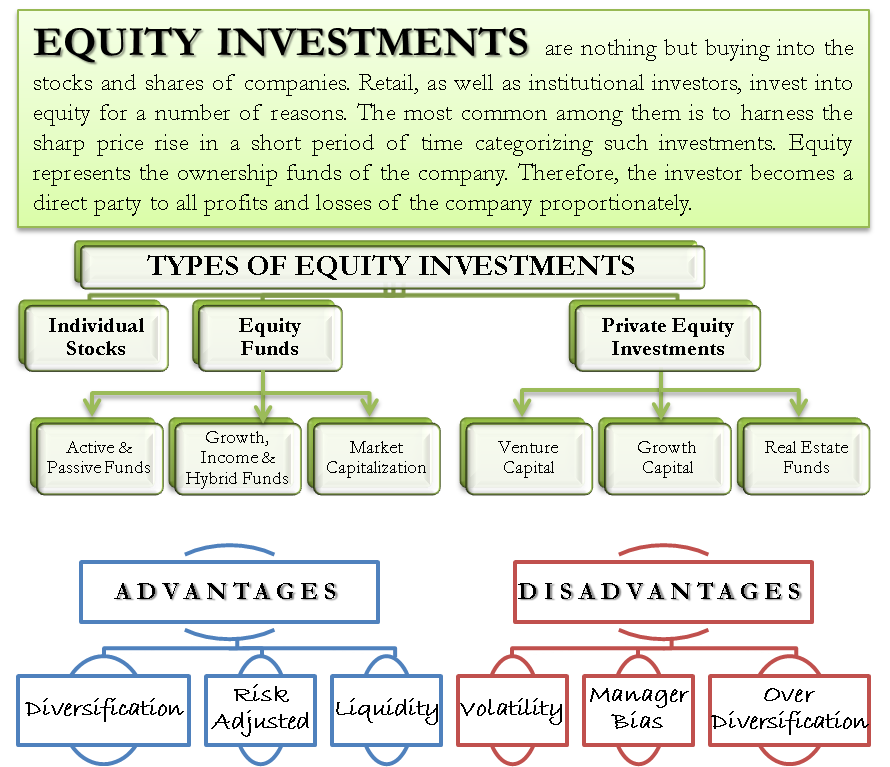

Even though one another holds and you can securities try popular money options, there are a few secret variations to be aware of before paying your bank account. Depending on the sort of thread, you can get her or him as a result of on the internet brokerage accounts, shared finance, exchange-traded finance (ETFs) otherwise individually from the government or authorities service. By purchasing holds, you could potentially probably create your currency as a result of financing enjoy, meaning the new inventory’s price develops. You might like to earn returns should your organization directs a share of their money in order to stockholders.

Financing Purpose

Including, particular latest large-profile IPOs is Spotify (SPOT) and you can Uber (UBER). When these companies performed its IPOs, it obtained billions of cash on the a huge number of investors just who purchased their offers. While you are nearer to old age, you’ll typically require a bigger percentage of your own profile inside the stable possessions for example bonds. Yet not, for many who’re next from later years, you could generally manage more exposure which have possessions for example brings. Certain holds provide the repaired-income great things about bonds, and many ties be like the better-chance, higher-get back nature from carries.

Carries vs. securities

They serve some other spots, and several investors you’ll benefit from a variety of both in the portfolios. Diversification is a vital way of handling financing threats — and a portfolio containing a mix of holds and you can securities is actually far more diversified and possibly safe than a just about all-stock portfolio. The greatest risk of inventory investments is the express value decreasing once you’ve purchased them.

Of a lot brokerages now and enable it to be private investors direct access to business thread items, Treasuries, municipal ties (munis), https://predictwallstreet.com/project/evolution-zenith and you may certificates from deposit (CDs). The company agrees to expend you 4 per cent annual desire more ten years. Until the organization goes broke or runs into serious economic troubles, it’s likely that you’ll receive what the organization guaranteed and you will disappear having $step one, many years later on. However, while the bonds tend to be secure, your acquired’t have the opportunity to enjoy because the high an income since the you would having holds. If you’re seeking the chance to earn increased go back, you’ll most likely want to consider committing to holds. However, seeking to highest productivity out of high-risk securities can be beat the purpose of investing in securities to start with — to help you diversify from equities, uphold funding and provide a pillow for quick field falls.

Seven Tricks for Much time-Identity Spending Out of Australia

Alternatively, they buy ETFs or common financing one to keep a container various carries. Stock people love investing an excellent organizations for the reason that it form that inventory prices are going to increase. It indicates the trader often theoretically qualify step one% of your own business’s coming money and cash flows, and you can step 1% of the many returns paid so you can shareholders. You to definitely major difference between the bond and you may inventory locations is the fact the stock market provides central metropolitan areas otherwise exchanges in which carries is traded.

The newest calculated values may have been some other should your valuation price were to were used to help you assess such as philosophy. Your own trade account, having fun with a share business software, will assist you to purchase and you will trade in the newest security field. As the a beginner, you’ll want issues in this way ahead of time investing various other asset categories than equities. Hopefully, by the time your wind up looking over this, there’ll be most of your basic issues answered regarding the shares and you will securities.

What’s the essential difference between Dividend Brings and Ties?

Which awareness can make thread cost vibrant, specifically while in the monetary transform. To possess buyers instead of accessibility to thread locations, you could however access ties thanks to bond-concentrated mutual finance and you may change-replaced finance (ETFs). The bond market doesn’t always have a central place to change, meaning securities primarily promote over the counter (OTC). Therefore, individual traders do not generally take part in the bond field. People that do are higher organization investors for example your retirement financing, fundamentals, and you will endowments, as well as financing banking institutions, hedge financing, and you can investment government organizations.

Thread finance people experienced an entire force of one’s freeze inside thread ETF and mutual financing prices. However, people which kept ties in person and may also hold him or her because of maturity just weren’t met with so it downside while the thread issuers have been however obligated to fully pay back the new redemption property value the brand new ties. It’s really worth noting one to bond money subject people far more to desire-speed volatility. Even as we noticed within the 2022, bond rates damaged in the event the Government Set aside greatly enhanced interest rates as a result of the inverse relationship ranging from thread prices and you will rates.

It’s nearer to a bond, that have a redemption speed, an appartment dividend, and generally a great redemption go out (meaning the business have a tendency to pay traders the new redemption worth as well as returns owed). After you’re also young, the prospective day financing mostly spends inside the carries. But since you close the focused retirement age, the newest finance becomes all the more traditional and shifts their opportunities to help you ties. They provide profile diversity, so they really’lso are a fair choice for passive, hands-of investors. The newest calculator provides members that have an indication of an enthusiastic ETF’s yield and you may period to have certain market value.

For reveal description away from how the fund is calculated and you can delivered, excite understand the Estimate Cash Sharing. February’s shipping try $twenty-six,541,633.03 (January’s shipping try $24,431,614.59). To find carries you would like a percentage trading membership collectively having a demat membership. Certainly one of securities, bodies bonds, commonly named G-Secs, are among the safest.

Whenever investing bonds, you are credit cash in get back for normal costs (called voucher desire costs). Unlike to buy an integral part of the organization like you do having offers, bonds encompass your, the brand new investor, financing the business, or even the regulators, currency. Anyone can purchase shares through the stock-exchange, with assorted transfers available in other countries. Australian companies that is in public replaced is on the ASX to own people to shop for otherwise sell shares. Inside the evaluating individuals financial products and you can features, we’re incapable of evaluate all the merchant in the industry thus all of our rankings do not make-up an extensive overview of a certain industry.

Comments

Comments are closed.