Exactly How In Order To Consider A Loan Along With Money Application Borrow

This Particular utilizes Brigit’s protocol to be capable to forecast when a person might run lower upon cash and automatically covers an individual to prevent a great unwanted overdraft. Answer a pair of fast concerns, in add-on to PockBox will quickly fetch loan quotations from upwards in order to 50 lenders, thus you may find the particular offer you that will works finest with regard to a person. Dave will be 1 associated with the particular the majority of broadly utilized borrowing programs, in inclusion to our own amount decide on regarding when a person require in buy to acquire funds quick. As Soon As you examine in case this function is usually available to an individual, it’s a pretty straightforward method.

Stage Just One: Check Your Membership And Enrollment

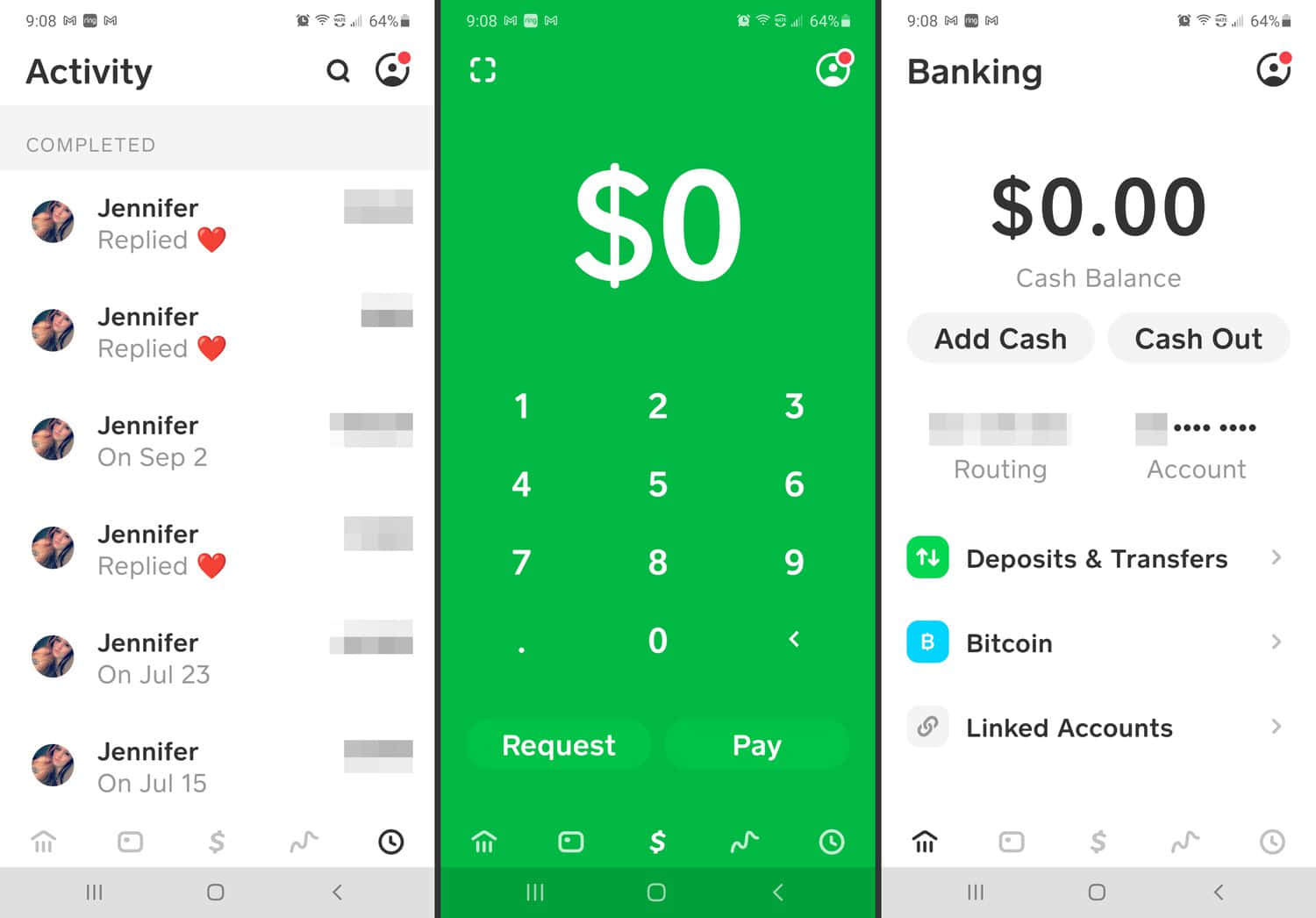

In Purchase To find away when you’re qualified in buy to employ Borrow, click on the Funds switch on typically the base remaining of typically the app’s home display screen. If you don’t see Borrow within your own application, an individual could’t consider out there loans right now, yet a person may possibly end up being capable to end up being capable to within typically the upcoming. In Accordance to become in a position to a Cash Application spokesperson, simply particular prescreened consumers usually are entitled to make use of Funds Software Borrow. Borrow is usually invite-only, and membership and enrollment is usually determined by simply aspects such as exactly where you reside (the characteristic will be accessible inside 36 states only) and your current exercise within just typically the software itself.

Finest $50 Mortgage Instant Programs Online: Zero Credit Examine, Zero Primary Downpayment Required

Before all of us move on to end upwards being in a position to show a person how to become able to borrow money from Money Application, we want in order to explain to an individual this specific is usually a limited feature regarding today. In Add-on To sadly, Cash App is usually also fairly secretive concerning just how it decides membership. If an individual do not satisfy their particular eligibility specifications, an individual will not necessarily be able to make use of typically the borrow characteristic about the particular Money software.

Exactly How To End Up Being In A Position To Delete Communications Upon Apple Enjoy (an Effortless Guide)

An Individual could explain to if you’re capable to borrow money from Funds Application because the particular alternative will become accessible to a person on typically the primary menus. Just About All a person want to perform is tap the alternative, and you’ll become used in buy to a page exactly where an individual may study exactly exactly how the particular feature performs and borrow funds upward to the particular limit associated with $200. Klover will hook up in purchase to your current lender account via Plaid and evaluate your own latest transactions. Within (totally NOT) surprising reports, repeating deposits usually are generally the key conditions to become capable to scoring a cash advance.

Coronary Heart Paydays, upon typically the some other hands, stands out regarding its inclusivity, higher mortgage amounts, plus clear terms. Regardless Of Whether you’re going through a good emergency or planning a considerable expense, Coronary Heart Paydays ensures a smooth borrowing knowledge focused on your requirements. This feature should end upwards being utilized moderately given that a person need to repay in the subsequent several weeks.

Conclusion: Will Be Coronary Heart Paydays Far Better Compared To Money App?

Achievable Financing will be a payday mortgage alternative of which provides loans of up to $500. Typically The application charges lower attention prices than conventional payday loans, plus a person could pay off the mortgage inside repayments above a few of a few months. Overall, if you make use of Cash Application Borrow responsibly plus create timely repayments, it can have a positive influence on your credit score.

It’s created with respect to speedy entry in purchase to money whenever you require it the the better part of, such as regarding unpredicted expenditures or bills. I keep in mind typically the 1st moment I utilized it; I had been brief upon cash before payday plus it experienced like a godsend. An Individual may borrow in between $20 and $200, which often will be pretty handy regarding small needs. An Individual may possibly end upward being in a position to borrow once more proper after spending away your current mortgage. Nevertheless, your current membership and borrowing restrict for long term loans can become influenced simply by your repayment historical past in add-on to how Money Application opinions your creditworthiness. Constantly pay back on period and borrow reliably to end up being able to enhance your current probabilities of getting approved again.

Continue Reading Through

In Order To be eligible, an individual must end upward being at the extremely least 18 many years old, in addition to membership will be limited in purchase to residents associated with particular declares. When an individual be eligible, you could discover Funds Application Borrow in simply a pair of methods. However, Money App team holds regular sweepstakes plus giveaways on their recognized social networking balances.

- Cash usually are usually available instantly right after verification associated with your borrowing request.

- Several economic institutes choose Caldwell as the particular brilliant supply regarding academic personal financial content.

- They’ve recently been screening a brand new feature that will enables an individual to borrow money straight from the app.

- Money Application offers rapidly produced directly into one regarding the most-used e-money apps within typically the globe today, helping more as in comparison to 55 million customers by simply the particular conclusion regarding 2023.

- The Particular Money software is usually a well-known in inclusion to convenient system to move money from your own lender account by indicates of a mobile phone software in the particular United Declares and the particular United Kingdom.

Is Usually It Secure To Make Use Of Cash Application For Borrowing Money?

Thus if an individual’re short upon funds in add-on to require to borrow cash, will be it smart in order to borrow money cash advance app make upward typically the deficit along with a Money Software financial loan, plus usually are right right now there potential dangers involved? As with the majority of things, right right now there are usually definite rewards plus downsides. PS discussed along with financial specialist Travis Sholin, PhD, CFP, to be able to learn just what prospective consumers need to understand regarding how to borrow money through Cash Application. If an individual fulfill these varieties of specifications, you’ll most likely become provided different levels of borrowing choices.

As we all described, the particular Money Software Borrow function isn’t obtainable to end up being able to every single Cash Software user. Rather, it’s granted centered about external needs that several may only suppose at. A Person may very easily check to observe if a person have got Cash Application Borrow access by simply beginning the particular app plus pressing upon your own bank account equilibrium inside typically the lower left-hand nook. Simply Click typically the house icon to end up being able to understand to be in a position to the banking segment of the application. Although right now there will be zero elegant application method to be eligible regarding a Cash Software Borrow mortgage, an individual will want to become a good present member in add-on to have got an account that’s been lively with respect to a although.

Cash Software Borrow Repayment Structure

Be certain to become able to evaluate attention prices in add-on to charges just before picking a lender. When an individual have got poor credit, an individual might possess less alternatives obtainable to become in a position to a person, yet it’s continue to feasible to be capable to find a loan that will performs with consider to you. Chime is usually a mobile banking application that offers a good overdraft characteristic.

- But, your current membership in addition to borrowing limit regarding upcoming loans may be influenced by your current repayment background in add-on to exactly how Cash App opinions your own creditworthiness.

- A Person need to at least link your bank bank account in inclusion to on a normal basis add cash to end upwards being capable to your own Money Application.

- In Buy To qualify, an individual need to be at the extremely least 20 yrs old, and membership and enrollment is limited to end upwards being capable to occupants regarding certain states.

- Credit Score history alone is important any time it comes to virtually any loans.

- The Particular Funds Software Borrow loan is usually not designed in buy to be a long-term solution.

Enable allows you ‘Try Before An Individual Buy’ along with a 14-day free of charge trial regarding first-time customers. But watch away – put within high express fees plus get cajoled to become able to keep suggestion, in add-on to you’ll observe why we all discovered Enable to end upwards being able to be a single of the costlier applications that lend an individual funds. As a membership-based funds advance, B9 arrives with merely ONE fee along with zero express costs, recommended ideas, or late costs.

Comments

Comments are closed.