Get a hold of 5 Reason why You desire Financial Defense | SBI Lives

Insurance Rules & Monetary Recommendations The majority of people has additional feedback when it pertains to mortgage shelter techniques. Some are of thoughts you to definitely home loan safety is going to be clubbed that have established term insurance coverage. Some actually claim that techniques such as these commonly harm the fresh people over it work for.

- learn

- knowledge center

- monetary suggestions

- insurance policies axioms & monetary guidance

- Pick 5 Good reason why You prefer Home loan Protection | SBI Lives

Find 5 Reason why You would like Financial Protection | SBI Life

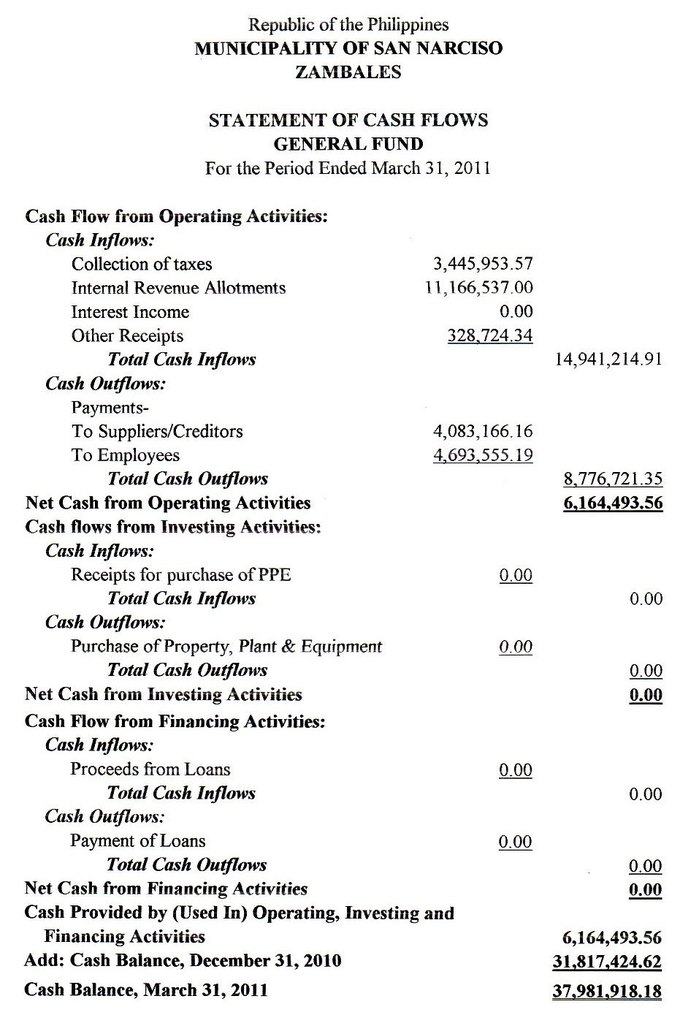

A lot of people possess other viewpoints regarding mortgage safety strategies. Some are of your own view you to home loan security shall be clubbed which have current title insurance coverage. Some actually suggest that schemes such as commonly damage the fresh buyers more than it work with. mortgage protection strategies act like identity insurance coverage. It insurance policies handles your loved ones should your individual that possess drawn the mortgage ends. The protection protection, upcoming said because of the loved ones, are often used to repay the newest the mortgage amount. The insurance coverage handles your up until the name away from loan payment. Why should we buy financial shelter strategies? The goals the fresh new electric of such strategies? Let’s look into certain grounds –

Protects the household

If there is a sudden passing on loved ones and it also often is the one who is actually paying the mortgage, in that case, the household has to pay back the fresh a good amount borrowed. However, if, your family cannot accomplish that, the house and/or collaterals facing that mortgage might have been pulled could be seized of the bank to invest the latest an excellent loan amount. If there is a home loan security available next this situation is going to be stopped. The household must allege the mortgage defense number that the insurance rates covers. In this situation, even after a loss of the loan holder, your family isnt instead property. Which, it scheme is a must if you wish to manage your family in the event of an eventuality.

Knowing your financial budget just take under consideration their most recent money and it is possible to upcoming money. You need to take the deals into account and don’t forget to help you kepted some money for an urgent situation. This formula can help you figure out your financial budget and then you’re on the right path to find your dream home.

Covers the latest Advantage or other Collaterals

If there is the new expiry of your own loan holder, our house or other rewarding assets are going to be captured to repay the fresh the amount borrowed. Even if the family members manage to save our home, they’d nonetheless remove their valuables. In this case your house financing security strategies include the fresh new possessions from the paying down the fresh new a fantastic amount borrowed. And therefore, even when the financing holder ends, they means that that isn’t at the expenditures of one’s family or its quality lifestyle.

An easy task to Spend Superior

financial security strategies acts including a term insurance policies. One-date premium is going to be paid for getting the system. There might be a posture where the loan bearer are unable to afford the latest superior. In this instance, the newest premium count is actually placed into the mortgage count and you may deducted due to monthly otherwise quarterly EMIs. Such as, when your complete loan amount was Rs twenty-five Lakhs while the one-go out superior try Rs 2 Lakhs. Then the complete loan amount becomes Rs twenty seven lakhs and repayment happen as a result of EMIs. This will make it simple for the latest commission of your own premium. Quit facility, according to terms and conditions of Cherry Hills Village loans your design, is readily available for one to-time superior payers.

Comments

Comments are closed.