USDA Declares A lot more $250 Mil in Financial help getting Troubled Farm Loan Individuals

Washington, – The newest U.S. Agency from Farming (USDA) revealed an additional $250 mil for the automated repayments for disappointed head and you may secured ranch financing consumers under Part 22006 of one’s Inflation Cures Work. That it tall action continues on USDA’s commitment to keeping producers and you can ranchers financially feasible and you can help having farming communities.

Just like the financing upkeep actions that were paused due to the COVID-19 pandemic restart, for example Mutual Prefer Arrangement recaptures, this additional debt obligations you certainly will honestly impression borrowers that happen to be currently stressed

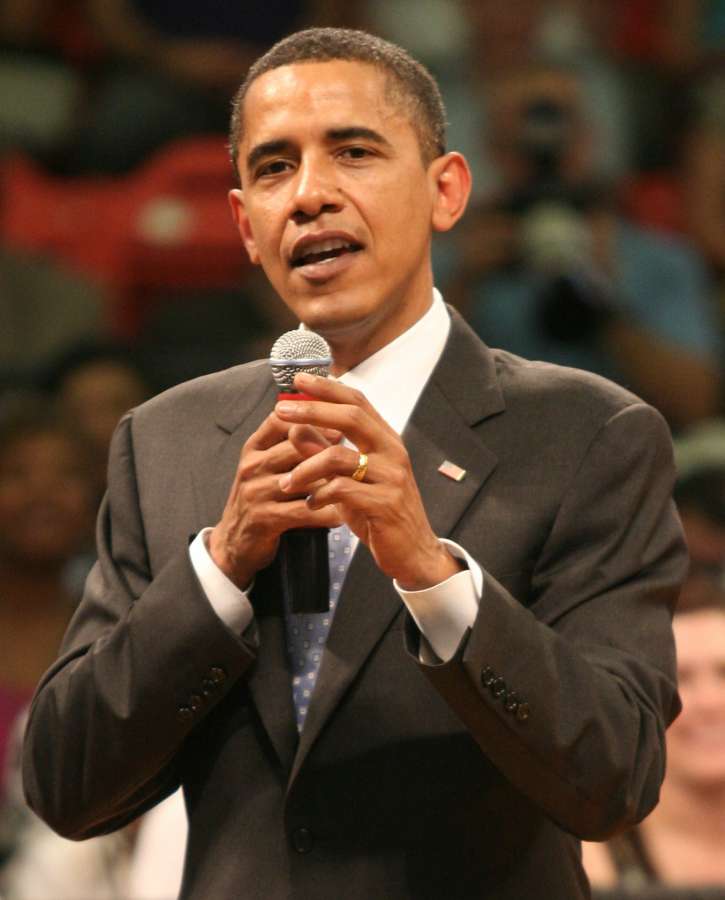

For the past 2 yrs, USDA acted swiftly to greatly help borrowers *in the sustaining its homes and continuing its farming functions. Since Chairman Biden finalized the new Rising cost of living Prevention Work into the laws when you look at the , the fresh new USDA has provided everything $2.4 billion from inside the help over 43,900 troubled borrowers.

Guaranteed mortgage borrowers are not said to be inside the financial default up to a month overdue

USDA will continue to invest in the ongoing future of providers by way of our loan profile. These ongoing investment made possible by the Rising cost of living Avoidance Act become towards pumps away from vital Farm Services Company Mortgage Reforms that turned into productive the other day, told you Zach Ducheneaux, USDA Ranch Provider Agencies (FSA) Administrator. Brand new repayments announced today assist to guarantee that over cuatro,600 companies all over the country may find another manufacturing 12 months. Notably, but not, we are really not only handling newest crises. We are along with creating an even more long lasting and you can supportive mortgage program getting the near future.

Building about this impetus, USDA is proclaiming an estimated extra $250 mil in the assistance to whenever cuatro,650 distressed head and you will protected farm financing individuals. This consists of around $235 mil inside guidance to own an estimated 4,485 delinquent head and you may guaranteed individuals that have perhaps not acquired early in the day IRA 22006 guidance, and you will up to $15 million when you look at the advice to possess a projected 165 lead and you can secured borrowers that have Common Prefer Agreements.

Disappointed FSA individuals that have finance covered because of the real estate must sign a discussed Fancy Contract after they accept loan servicing tips that jot down a portion of the lead or guaranteed obligations. FSA must recapture a portion of one generate-off in case your property value of your own real estate security increases when the contract grows up. Individuals have to sometimes pay off which count https://clickcashadvance.com/installment-loans-tx/ otherwise obtain it converted into a destination-accruing cost arrangement.

To possess lead borrower delinquency direction, FSA could make an automatic percentage in the quantity of people a great delinquencies, as of , toward qualifying head debtor financing that are one or more weeks outstanding, at the time of one to day, considering those people individuals haven’t obtained earlier Section 22006 recommendations you to was applied to attenuate an immediate FSA mortgage equilibrium (leaving out guidelines getting Crisis Lay-Asides and you can Emergency Funds).

To possess guaranteed debtor delinquency costs, FSA usually mail via consider an automatic percentage about amount of any an excellent delinquencies, at the time of , towards qualifying protected funds that are 31 or more weeks outstanding, by one go out, offered those borrowers have not gotten earlier Area 22006 guaranteed loan advice. It recommendations will be in the type of a beneficial You Company of your own Treasury be sure try together payable on the borrower and lender.

For individuals researching direction on the Shared Appreciate Preparations, an installment is built to manage a great amortized installment agreements and recapture amounts due so you can FSA having mature since . Individuals whose Mutual Appreciation Arrangements have not matured as of , is called of the FSA and you can given a chance to demand you to definitely FSA assess a limited recapture and Mutual Fancy Agreement guidelines render.

- To have borrowers whose Common Appreciation Contract had in past times matured and receivable due are changed into a discussed Really love Percentage Agreement prior so you’re able to , Shared Really love Agreement advice is equal to the quantity off a fantastic dominant and you can desire due to the commission contract out-of .

Comments

Comments are closed.