Just what advice programs are around for Fort Worth home buyers?

Great things about Homeownership having Very first-Date Buyers

To order a property the very first time boasts several benefits that will make a significant difference inside a person’s financial coming. These positives are the means to access special tax credits therefore the chance to construct collateral and you will wealth.

Taxation Loans and you will Benefits

First-date homeowners will enjoy numerous economic masters as a consequence of income tax credits. Applications such as the Financial Borrowing Certification System ensure it is property owners so you can allege a credit to possess part of their mortgage desire, that will slow down the level of federal tax due.

An additional benefit is the power to subtract financial focus out of taxable earnings. Which deduction can lead to high income tax coupons, particularly in the early numerous years of a home loan whenever focus money try higher. Possessions tax payments are also typically allowable, taking further economic rescue.

Government-recognized financing such as for instance USDA financing bring advantages to first-time consumers by permitting for lower down costs, and also make homeownership more available. Such economic gurus slow down the price of home ownership and you can can be raise a good homeowner’s complete monetary wellness.

Building Equity and you may Wide range thanks to Homeownership

Homeownership is one of the most effective ways to make a lot of time-title wealth. In the place of leasing, where monthly installments dont trigger resource buildup, to get a home allows individuals to create collateral. Security ‘s the difference in the modern market value of your own house as well as the a great financial balance.

Over time, since financial was reduced, the brand new collateral at your home expands. It broadening asset might be a supply of riches, given that possessions https://elitecashadvance.com/loans/personal-loans-with-no-bank-account thinking have a tendency to go up. Homeownership now offers safety, given that buying possessions can protect up against rising prices and increase financial balances.

Participating in very first-date homebuyer programs normally then help in money strengthening by simply making purchasing a house more affordable. These types of apps will bring favorable financing terms and conditions and certainly will assistance with down payments, making it possible for basic-day consumers to begin with its homeownership excursion that have less obstacles.

Frequently asked questions

First-big date homebuyers into the Fort Really worth features several options having financial help and you will features. It section solutions secret questions regarding qualifications, application procedure, and requires about to shop for a property.

So you’re able to be eligible for first-day household client grants in the Tarrant County, individuals generally speaking must satisfy certain money and you may credit requirements. Tend to, these types of gives require consumer are to shop for their first house or otherwise not possess owned a property prior to now while.

Applicants can apply to your $twenty five,000 very first-go out domestic client offer through the Homebuyer Guidance System inside Fort Well worth. Audience need see money qualifications standards and you can complete a good homebuyer knowledge movement.

Fort Well worth also offers multiple advice software, plus has, low-attract finance, and you will down-payment assistance. The fresh Homebuyer Direction System provides financial help to people who meet the requirements, reducing the brand new economic load of shopping for property.

Inside Colorado, first-day homebuyers need only 3% so you can 5% of your own house’s price given that a down-payment. Software such as for example FHA money could offer lower down percentage options to eligible people, and then make homeownership a whole lot more obtainable.

Most first-big date household consumer funds within the Colorado need the absolute minimum credit rating. To own FHA loans, so it get could be as much as 580, while old-fashioned fund often you desire a high get, generally starting in the 620.

Have there been earnings limitations to own engaging in the latest My personal First Colorado Domestic System?

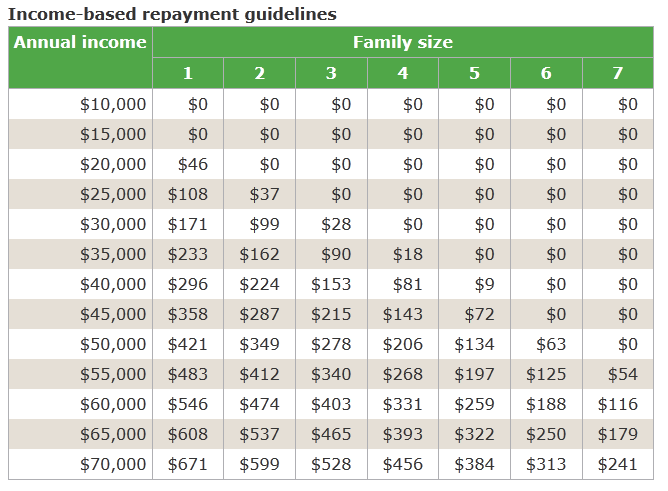

The brand new My personal Very first Colorado Domestic Program features income limitations centered on nearest and dearest proportions and you will region. Qualified customers need certainly to slide on these restrictions for experts and may including fulfill almost every other qualifications criteria eg are a first-big date homebuyer.

House Sweet Tx Home loan Program

Pre-approval relates to a credit assessment, proof of income, and you will a peek at credit history. It includes consumers an exact comprehension of whatever they can afford and assists improve this new to purchase procedure.

Fort Worth’s steeped sporting events culture and you can reasonable entertainment rooms sign up to an active lives. If or not looking to distance so you can the downtown area to possess functions or a residential district feel, customers discover neighborhoods one matches its homeownership fantasy into the Fort Worthy of.

Comments

Comments are closed.