Score a quotation from your own bank one which just place a contract on the a house

Buying a house for the very first time are enjoyable and you may exhausting at the same time. Utah’s housing market is quick moving and you can aggressive. Discovering what you can do to assist mitigate tiring affairs and to arrange yourself to find the best likelihood of taking an enthusiastic offer recognized on your own the Utah family.

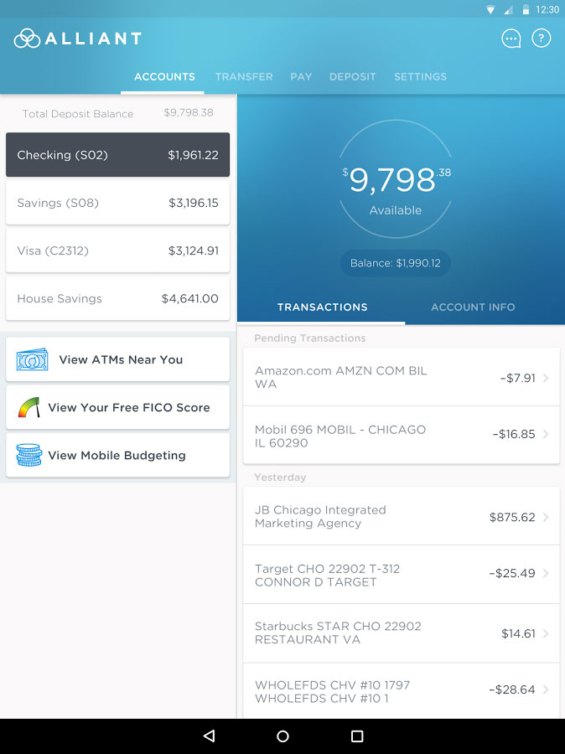

Score an offer Out of your Lender

Regional Utah loan providers is better yet. Their financial ought to provide projected settlement costs, how much cash their payment might be, all those one thing, therefore you may be completely alert to what you are probably need spend at the closing, what your payment have been in complete, ahead of time. Just like the the majority of people, it get the pre-qualification, “Oh, I am prequalified to have $190,000.” And then each goes on the looking. However, sometimes they skip, “Precisely what do I need for closing costs? What do I bad credit loans in Boise,ID want? What is my personal real percentage likely to be?” And sometimes, some lenders instantly give you a quote once they make you the brand new preapproval, however, an abundance of lenders usually do not. So that you need request that preapproval at that time that they meet the requirements your, perhaps not their preapproval. Request this new imagine at the time it qualify you.

Score Several Estimates of Loan providers

Which property suggestion happens also the idea above. Don’t just get one quotation off a loan provider. I am aware the majority of they do say try, “It’s going to damage my borrowing from the bank.” The FICO scoring design allows you to score numerous estimates within this a short while period for the very same funding variety of. Thus every mortgage brokers, once they pull the credit, they truly are move their borrowing less than that money types of. Don’t know precisely what the number is, however, say the number try about three. They’ve been every putting in around three. So that the FICO scoring model knows that you happen to be applying for three some other mortgage loans, this just influences their borrowing immediately after. If you’d like assist wanting quality Utah Home loan Officials give us a call we are able to let.

Get Associate

Cannot match the brand new list broker and/or builder. He’s got the fresh new providers welfare at heart maybe not your personal. Ensure that individuals is representing your very best desire, particularly given that a first and initial time home consumer, which is capable direct you from the procedure. Whether you’re undertaking this new design otherwise selling, have your individual agent representing your. It is 100% free to you personally.

Comprehend the Mortgage Brands

There are just four mortgage sizes, so i need to make one precise. If you are trying to get a home loan, you happen to be either making an application for an enthusiastic FHA mortgage, and i feel the FHA loan clips, a traditional financing, a good USDA loan or a beneficial Virtual assistant mortgage. There are just five sort of funds. Now in FHA, there can be more software one to a loan provider may have you to end up in FHA, otherwise one to end up in antique, however, there are only five loan designs, and usually you could potentially distance themself two of the individuals designs, since the Va is for experts as well as their spouses, or USDA is in outlying section. Therefore many people are being qualified to own both FHA financing or conventional financing.

Proprietor Occupancy

Very really mortgage loans, you get an educated cost additionally the lowest down payments if you find yourself likely to proprietor-reside one to household, which means you will probably in fact transfer to one family. And how would they are aware you’re transfer to one to household? Fundamentally, as you signal proclaiming that you will transfer to that house. As well as have, they are aware you may have employment that is extremely close to in which the spot of the home is actually. So particularly, if you’re residing Arizona, and you’re seeking purchase a house in the Utah, therefore lack a position but really inside Utah, that isn’t holder occupancy, if you don’t can be that you are a secluded staff, which people possess gone to live in digital. When you get some sort of verification from your manager one to you functions from another location, following which is you can easily.

Comments

Comments are closed.