And make Fund to aid Earlier Incarcerated Somebody Go back on their Foot

CDFIs and you may nonprofits is actually determining tips help previously incarcerated individuals generate borrowing from the bank records and you may availableness money receive the lives heading.

#197 Winter months 2020 – Incarceration to Community

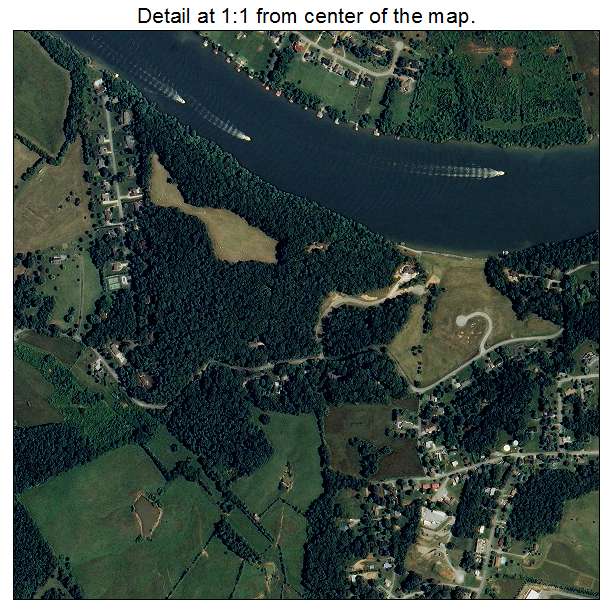

James Knauss become his or her own surroundings business titled Transformalawn. Knauss, who was formerly incarcerated, were able to score a business financing out-of Promise Enterprise Organization.

To make Loans to greatly help Formerly Incarcerated Anybody Get back to their Foot

Inside 2017, Brenda Davis was in the long run totally free . She would already been found guilty out-of monetary crimes and you can given a great 10 -12 months sentence, and you can immediately after five years inside the jail, she try from parole. But any sort of thrill she’d got regarding new lease of life ahead of their are easily tempered because of the raw information encountered by on the visitors who’s got been incarcerated .

You simply can’t rarely get a hold of a spot to accept an unlawful number, are unable to barely lease a gap to accomplish things within the. Its dreadful, she says . We sought out to get a normal job, together with merely metropolitan areas which will get me is actually McDonald ‘ s otherwise Burger King-also Taco Bell would not get regular .

People that recently been put out away from prison or prison battle to get their existence heading, and you can supply of money is key to one work. Some features expense that must definitely be cleared up just before they may be able move ahead; other people you desire currency to get down a deposit on the a place to reside acquisition to attain specific versatility. And in some cases, the prospect away from doing their unique team looks likelier than just landing a complete-big date employment which have guarantee. But shortly after ages at the rear of pubs, of numerous returning people enjoys not everyone to help you trust and you can nothing or no credit history-for example take to each other actually a little contribution are almost impossible.

Anyone come-out with nothing: zero social networking more, situated how long they are in prison ; n o location to live ; no business . A beneficial nd their loved ones might not have much often. It is a good h uge burden, says Donna Fabiani , professional vice president to have degree revealing during the Options Financing System, a nationwide connection out-of area invention loan providers (CDFIs).

The will are immense. Currently, more 70 million Americans-almost one out of three grownups in the office age -ha ve a criminal history. And many of these affected have been currently terrible and you will marginalized ahead of their conviction: you to report rates one to 80 percent ones currently incarcerated is actually low income and therefore forty % of all of the criminal activities was estimated becoming associated with poverty.

Having a criminal history does not, in itself, bar some body from getting a business mortgage. But the majority of some one exit jail having grand expense , usually on thousands of cash, out of conviction-related will cost you, skipped payments, prison fees, or child assistance. And several of them costs, particularly when they’re outstanding, can display through to a credit report . Anybody with invested ages from inside the detention are also popular plans out of scams and you may id theft. An effective ll of these anything can affect their capability attain usage of resource. check out the post right here At all, having good credit setting being able to have indicated a reputation sensibly managing financial issues over time.

CDFIs have always focused their jobs into the underserved teams. Up until now, no matter if, previously incarcerated people don’t discover far notice. However, just like the You . S . fairness system and its failings ha ve grown throughout the national consciousness for the past while, neighborhood lenders and other nonprofit organizations have begun so you’re able to tailor software to own fairness systemon it individuals, performing particular mortgage affairs, credit scoring solutions, and also company programmes that will easy the way to effective existence.

Davis is among the people who found her method on the the firm globe to produce a full time income . Today, she is try a business owner inside the Tx Springs having a puppy brushing company, Clip-n-dales, that’s just about to go live. One victory ‘s the effects not simply of their own tenacity and perseverance, plus of a couple of visionary applications that assisted their own get ready and you can enter the providers world . Whether it was not having [ those people applications ], We would not see the content I wanted to know, says Davis.

Comments

Comments are closed.