Should you Use a good Co-candidate Whenever Applying for Money?

But not, without having a member of family to assist and ask providers couples, there is also a share on the possession element, very be mindful from the person you like.

Here are the methods for taking to find out if a beneficial co-candidate plan works well to you and the extra individual in it:

Why are men a Co-applicant?

When selecting a co-candidate, you will want to select anyone you faith you to definitely lenders can also be, also. This means emphasizing individuals with a wholesome earnings and advanced level borrowing. One tells lenders that the people are designed for the costs responsibly. Highest revenue are a beneficial signal that the co-candidate comes with the funds on hand if necessary.

However, to your an individual peak, this new co-candidate have to be someone your trust and you will speak openly to help you regarding the their moneymunicate clearly on them to construct a powerful economic plan and you can tweak it as expected along the way.

Benefits of That have an excellent Co-applicant

- Most useful Chance of Approval – Candidates which have lowest credit ratings (lower than 700) has regarding the an effective thirty-two per cent threat of their financial application are refuted. If you have somebody else’s good credit so you can back your up, you’re likely to listen to you are recognized to suit your personal finance.

- Straight down Interest levels – In the event your software is far more positive, you can acquire better terminology.

- Large Principals – Using this type of, the truth is more income. Several that have a couple of incomes can afford a larger household due to the fact he’s got a top earnings to one another. An identical suggestion works well with low-married people.

- Potential Borrowing from the bank Experts – No matter if their ratings is actually lowest, a reputation repaying the borrowed funds punctually can enhance your own scores. Definitely stick to top of the costs, and you may you and another debtor you’ll see an increase on your credit history. Yet not, this hinges on your own designs.

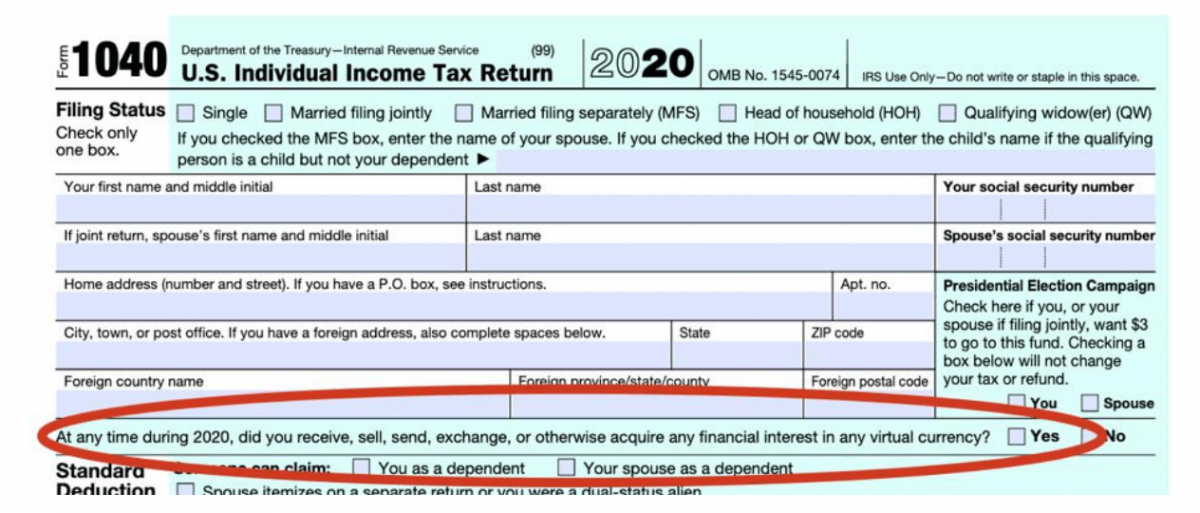

- Potential Taxation Masters – When itemizing your taxes, you can allege taxation deductions into financial interest costs made throughout the the season. Make sure to talk to a taxation elite group to see if this is exactly good for you.

What to anticipate While using the a beneficial Co-candidate for the an application

Are you ready understand what takes place after you work with co-individuals inside application techniques? Some tips about what to learn:

Simple Credit score and you can Credit score Take a look at

The lender looks at brand new applicant’s credit score and you may credit rating. For this reason, their earlier skills plays a role in just how loan providers decide to assist you. A good credit score profiles which have quick costs indicate that you might find even more positive financing words.

However, when you yourself have a dismal credit records, co-borrowing could well be finest. If you are each other matched up, you have got solid credit, while the financial is more gonna research positively for you into the software process.

Exactly how the typical Organization Works closely with a beneficial Co-candidate

Taking right out financing is a huge financial decision, therefore you should comprehend the methods within the procedure. That way, you have a whole lot more belief and will make better choice that actually work to easy cash loans in Skyline you personally.

- The financial institution requires the common credit rating of one’s first candidate and co-consumers. Therefore, it’s not necessary to figure out which people enjoys a far greater profile as noted while the first debtor. Both parties rating equal consideration.

- Will, the organization communicates with the no. 1 borrower a great deal more. Thus, it would be ideal for this 1 to reside brand new home, regardless of if their results is actually lower.

- Whenever implementing the application, the organization makes it easy to incorporate someone to the home to own co-borrowing from the bank purposes. By doing this, he’s legal rights to your term, therefore the combined income of your own no. 1 borrower and you will co-candidate is distributed with the financial team.

Comments

Comments are closed.