Extremely leveraged finance covered which have suprisingly low off payments bring reasonable threat of default

2nd, to invest in one-home isnt a professional way of strengthening riches, since the features don’t always delight in. In fact, Pinto’s studies have shown one to in several major places, for example Memphis and Detroit, a lowered-priced home can get gain zero worthy of more than years.

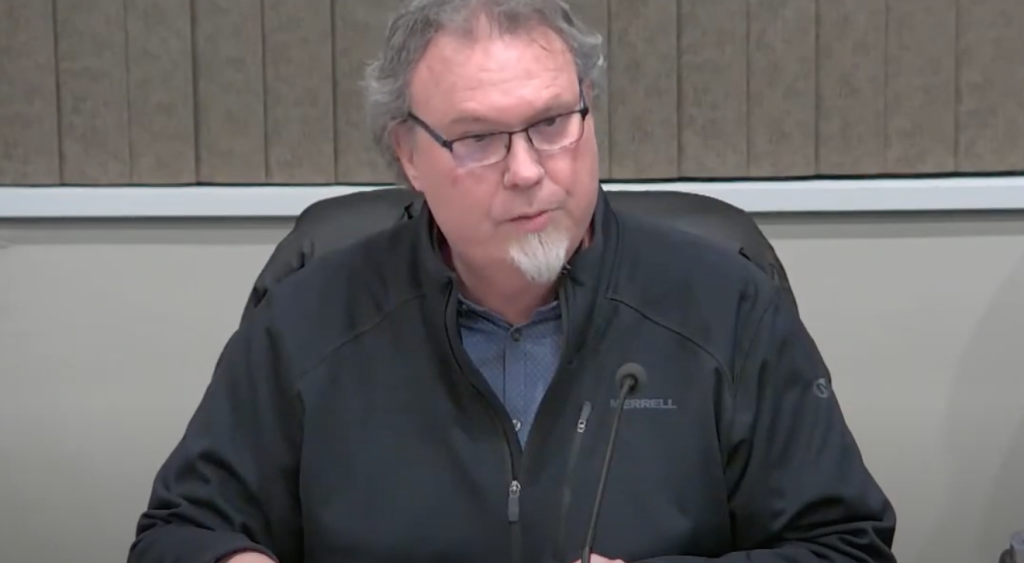

Pinto are resident other during the American Organization Institute and co-movie director of their Around the globe Center on Houses Chance. Knowing the dangers, the guy and an associate have devised a potential provider that already been produced around.

The fresh Wealth Builder Financial, created by Pinto and you may Stephen Oliner, including from AEI, solves each other those issues, that needs to be the objective of any homes coverage, Pinto claims

Wealth Builder includes an effective 15-12 months totally amortizing mortgage that requires zero financial insurance otherwise off payment. Instead, borrowers pay up front side to own mortgage purchase-down, which allows them to generate guarantee rapidly.

In the 1st 3 years out-of quite a lot Creator loan, in the 75% of one’s payment per month visits principalpare so it in order to a classic 30-season loan, in which regarding the 65% perform wade on desire.

Certain groups give you the mortgage loans within the possibly forty states, Pinto claims. Anybody else promote all of them just within bank’s very own impact.

Once the a community financial, we really want to purchase anybody within our groups and you will make the brand new and unique ways of performing one, so we pick products that will vary as to the we have now, teaches you Chairman and President Paul Andersen. Through the bank’s work on AEI, Joe Ferris, mortgage financing movie director, and Chris Logan, head lending manager, receive Wide range Creator Home loan and you will produced they in order to Androscoggin.

There are demands up against some body to order residential property, Andersen claims. Some of those is actually too little downpayment. Another are and come up with repayments work with all of them so they are able build security easier.

In the Androscoggin Bank the fresh Money Creator loan already keeps a predetermined speed of just one.75% on very first eight many years. For decades 8 thanks to fifteen, the rate is 5%-however the mortgage is reset from inside the action-right up time so the customer pays the greater interest rate, but just towards leftover amount borrowed.

Consequently, the higher speed is not with biggest sticker inventory. Ferris highlights that after 40 weeks of costs, an abundance Creator Financial gets right down to 80% loan-to-really worth proportion. Towards a 30-seasons mortgage, it takes regarding the 9 and a half years to arrive you to definitely area.

Complete, just what our company is looking to create are promote people’s prosperity, Andersen claims. This helps all of them lower their prominent quicker than having other affairs so they really develop a lot more guarantee than they could if not.

My daughter purchased property last year utilising the Money Creator Financial, Andersen claims. Inside her first year of experiencing which mortgage, whenever she performed their particular taxation statements, she spotted one $nine,000 out-of dominating ended up being reduced within just an excellent 12 months. Someone who had a thirty-year mortgage could have paid back $1,000 so you can $dos,000 because length of time.

Even though they want zero off money, Wide range Builder fund was reduced-chance. Androscoggin demands holders to possess a bank account from the bank detailed with lead deposit of its paycheck and you can automated move into their loan commission.

In the fifteen loan providers all over the country today bring Money Builder fund

The biggest risk getting banking companies in the death of mortgage loans occurs when our https://cashadvancecompass.com/personal-loans-ia/ very own customers have no collateral, Andersen shows you. Whenever they understand you to their home does not have any worthy of in a good downturn, they truly are expected to disappear, making me to foreclose or auction. Very Money Creator loans enhance the savings and decrease the dangers.

Comments

Comments are closed.