Package Your home Funding – Financial Emi Calculator On line

Interest

Us desire to purchase a house in our, a property for the families, and a place that is our constant through the change out-of lives. But not, to order a house is a significant monetary choice, the one that requires good-sized considered and you will believe. Not merely do you need to find out your residence mortgage budget and find ideal casing assets yourself along with your nearest and dearest, however you also need to dictate the main cause of the funding on the cost of our house. This is where home financing comes in!

small payday loan direct lender

Towards the supply of planned and easy mortgage brokers during the feasible prices, it is better to plan the acquisition from a home that fits your financial allowance and needs. You might gauge the feasibility of the numerous mortgage solutions in your case with the aid of a home loan EMI Calculator. Since the lenders are usually paid down in the way of Equated Monthly obligations (EMIs), the aforementioned tool is a great treatment for ascertain just how much money you shall must arranged monthly on repayment of your home mortgage.

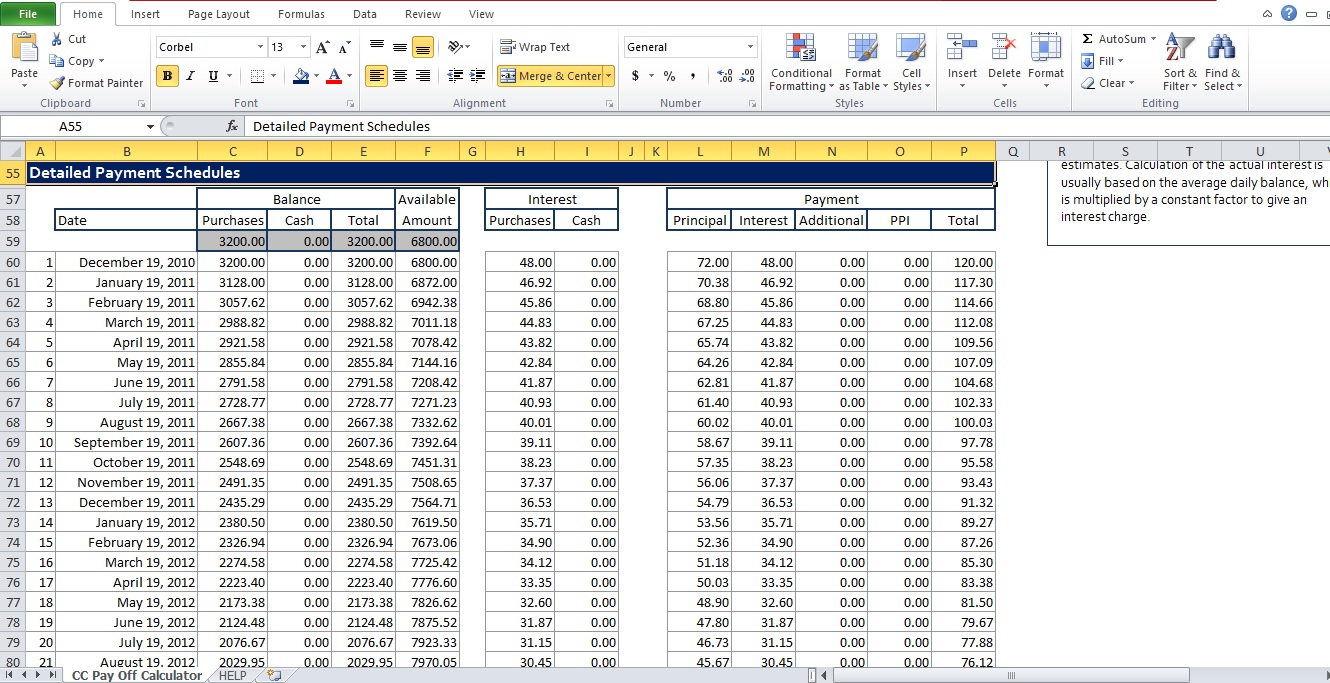

There are 2 major components of the payment out of property financing, particularly the main therefore the focus. Into the early stage of repayment of your property loan, a primary ratio of your own EMI try constituted from the focus on mortgage, while in the afterwards phase, this is the prominent you to definitely comprises a majority of the new EMI.

Points You to definitely Dictate Mortgage EMI

- The main matter approved toward financing

- The interest rate toward financial

- The latest period of your own financing

Just how to Estimate Financial EMI Having fun with Our very own EMI Calculator

You are able to Piramal Realty’s Home loan EMI Calculator so you’re able to compute new EMI payable for your home mortgage. You should go into the after the facts to reach that it value:

- The quantity of your house mortgage necessary for you

- New tenure of the property mortgage you need to opt for

- New appropriate mortgage interest rate

Benefits of using An EMI Calculator Getting A mortgage

There are numerous benefits of using home financing EMI Calculator. Here is how it product can help you in the process of one’s acquisition of your home:

- It assists you have decided how much to obtain:A mortgage EMI Calculator is enable you to decide how far in order to borrow, noting your ability to settle the mortgage. You can consider various combos of quantity of the borrowed funds therefore the loan period so you’re able to get additional EMIs, next purchase the integration this is the most feasible for you. By doing this, you could potentially ensure that you dont get home financing that’s outside of the monetary capacity to pay.

- It can help you decide that so you can acquire:By using a mortgage EMI Calculator, you might compare the home financing available from the other banking institutions and decide what type are most suited on financial requirements and you may budget. That it take action can help you select the right mortgage having oneself.

- It can help you regulate how to repay the loan:The understanding towards financial EMI you will want to pay off plus the tenure more than which you should make the new commission enables you to draft an economic propose to be able to honour such economic obligations. You could assess their almost every other obligations and view plans in order to satisfy every one of them, for instance the EMI. For example a method to your finances can be inculcate a premier knowledge out-of financial abuse in your behavior.

Comments

Comments are closed.