Do you Shell out into the a casing Loan When you are Strengthening?

Jessica Brita-Segyde

Are you in the market for a unique family? Into the deficiency of directory in the modern market, of many people opting for the new framework. If this sounds like very first-big date building, you happen to be wanting to know exactly how a construction loan functions.

Manage an agent

It is vital you to definitely people run a real estate agent. Its to your advantage to track down a consumer’s agent you like and you may trust before starting your house browse. There was a lot more to a set-up jobs than simply selecting counters and you may decorate colors! Their agent usually takes to the a lot of the pressure for you and can carry out their finest to quit delays. Are the areas of settlement, arranging, inspections, last acceptance, and you will weather, also it gets obvious: smart people render their icon on dining table. Also, extremely consumer’s representatives do not charge a percentage commission for their attributes. Simple fact is that supplier or builder you to definitely will pay this new payment bit on closure.

Delivering Pre-Recognized to own a homes Loan

Framework financing standards are like purchase finance however with a pair famous variations. Earliest, the financial institution will want to know if your currently individual the brand new lot or you plan to pick a great deal out of your builder. For folks who individual this new package but have a home loan or other mortgage whereby the fresh new house functions as collateral, the lending company usually takes that under consideration. You’re necessary to shell out-out-of the lot before a separate financial shall be offered otherwise you’re capable move the newest a fantastic harmony towards the lot financing to your brand new construction home loan.

It will be possible to order a lot to the open age big date, negating the necessity for much financing. In cases like this, extremely borrowers create receive you to definitely design mortgage before the start of the create.

In the end, for many who own the belongings downright (and no liens or mortgages), it may be measured since equity for the purpose of underwriting their design loan application. Really, you have got already paid for a fraction of your brand-new house’s collateral.

Basic Underwriting Conditions

It is good for understand basic underwriting conditions. These types of affect the new build as well as the acquisition of a preexisting property.

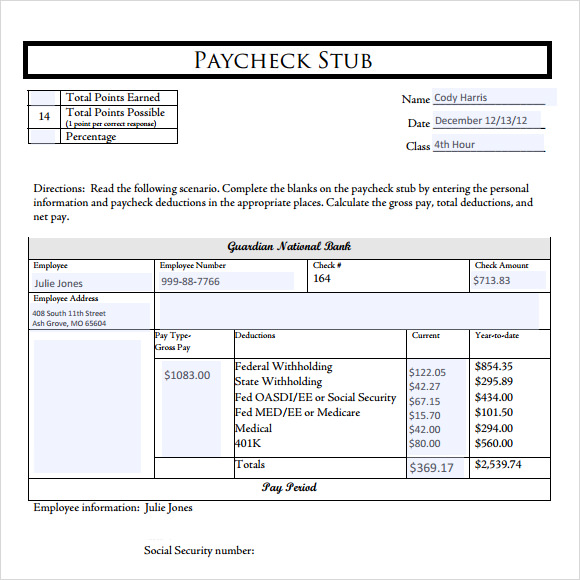

FHA – In general, FHA assistance require a debt-to-money ratio (DTI) out-of 43% otherwise shorter and you will a credit rating above 580. Straight down fico scores and you will/or even more DTI’s are appropriate, however the bank will raise the down payment demands in such cases. Individuals instead a credit score tends to be underwritten in accordance with non-antique borrowing guidelines.

Traditional Old-fashioned underwriting guidelines is actually stronger than simply FHA. While a beneficial DTI out of 43% continues to be appropriate, a credit rating of at least 620 is the community standard. For much more on Conventional loan conditions, take a look at the Federal national mortgage association Eligibility Matrix. This new Freddie Mac Provider/Servicer Guide is additionally a good guide, however, navigating these resources will be time-ingesting. To have short answers, get in touch with a great Ruoff Mortgage Professional.

Virtual assistant Virtual assistant loan providers constantly want to see a lesser DTI away from 41% or reduced, but the underwriter does have specific discretion right here (source: The latest Virtual assistant Lender’s Handbook). As with any Va mortgage, the brand new experienced-borrower need to payday loans online Alaska be considered qualified and you can present a certification regarding Eligibility (COE) and provide an acceptable credit score.

Appraisals and you can This new Framework

The brand new assessment techniques is going to be various other to own a property financing as opposed to the acquisition out of a current possessions. Anticipate paying as much as $500 for the assessment. This is often energized as an initial prices or folded into the the loan. Their lender is recommend regarding how brand new assessment fee are handled. After the could be the first components of all of the assessment, just in case the brand new appraiser is registered and you can utilized the Uniform Domestic Appraisal Declaration (URAR):

Comments

Comments are closed.