Buying a property which have Less than perfect credit and no Down payment

Each day anyone in the usa try to find a home with bad credit without deposit. If you have bad credit no money to possess an all the way down percentage, that could be you.

Why don’t we talk about certain means you could purchase property around these situations. The newest topics I’ll safeguards was:

How to get Acknowledged getting a mortgage

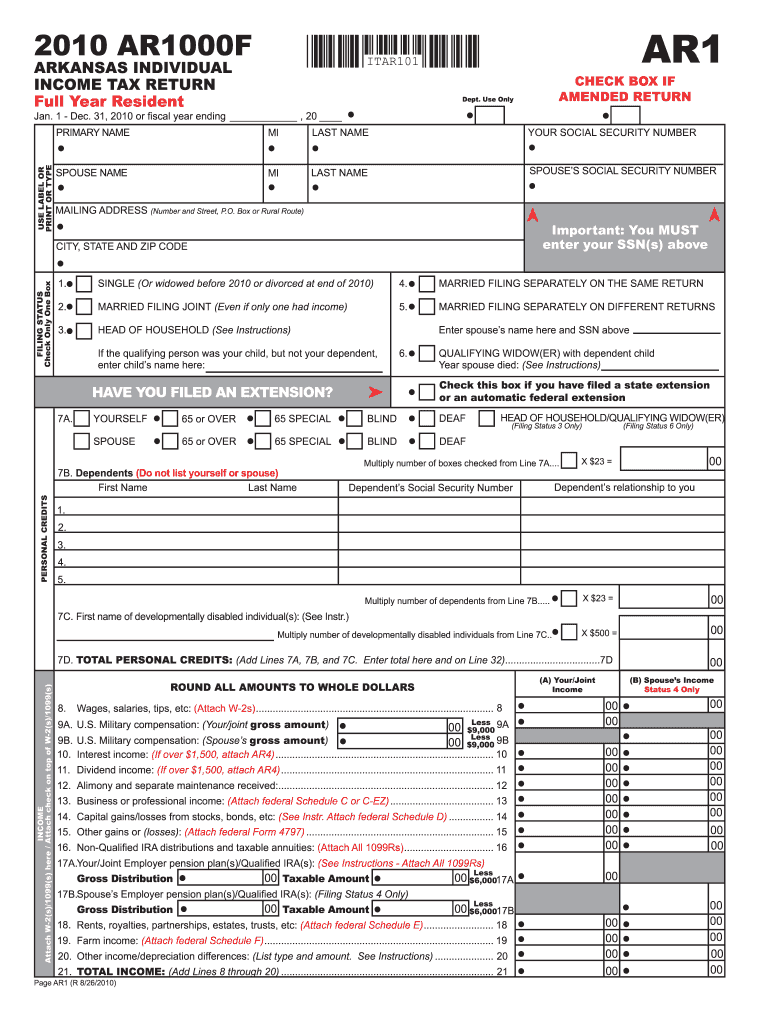

The very first thing you must do if you’re to invest in a property which have less than perfect credit without down-payment was establish you can create mortgage payments, despite exacltly what the credit history reveals. You will need recent tax returns, W-2s, bank statements and you will spend stubs. When you yourself have other earnings source, you will need to offer that into the dining table too.

For those who have costs, like many funds, medical expenses or any other sort of commission, make a summary of such too.

Your own previous and you may newest economy, and additionally what happened before, provides the lender wise of capacity to pay back the borrowed funds.

A typical example of an individual who is probably qualified to receive to get property that have less than perfect credit and no down-payment was some one located in a location that was hurt poorly on credit crunch. The person lost their occupations whenever a location plant signed. An alternative plant comes to urban area, in which he goes toward really works truth be told there.

If it providers possess a very good background, and the family buyer got a a position listing from the early in the day team, next lenders can look positively about this.

Useful Regulators Financial Applications

Creating throughout the San francisco bay area Gate, Meters. Shayne Arcilla, claims, Even though borrowing from the bank availableness and you can underwriting standards for most lenders is tight, there are solutions to the people who knowledgeable monetaray hardship and you will didn’t come with alternatives however, to face a property foreclosure or a case of bankruptcy recently.

Government entities has created mortgage applications to greatly help balance the new housing market that assist downtrodden property owners go back on their base.

The new Federal Casing Power (FHA) makes mortgage loans. FHA loan standards will vary than simply Federal national mortgage association and you may Freddie Mac computer. Bankruptcy and you will foreclosure are not automatic disqualifiers. FHA finance perform need some downpayment, step 3.5 per cent is common.

You’ll be able you could use this much into the a secondary mortgage. Nearest and dearest could probably leave you that much. Certain teams offer advance payment let too. Some states also provide applications for selecting a property that have crappy credit and no down-payment, especially for very first time homebuyers.

Keeps good Cosigner Help you to get Investment to have a home

A beneficial cosigner tend to considerably change your chances of delivering a loan should you have less than perfect credit or no credit. New cosigner is actually agreeing to help make the mortgage fee for individuals who cannot.

Both you and that individual lay the terminology to own repaying those funds. Put simply, youre to acquire a property having bad credit no down fee according to research by the cosigner’s borrowing from the bank.

Generate a property That have Habitat to own Mankind

Certain teams, Habitat getting Humankind is one of infamous, help some one go into house getting sweat collateral. Put differently, you help build our house. you commit to help build property for other people.

Discover a holder Who is Capital a property

This might be the easiest path to to purchase a property that have less than perfect credit and no downpayment. It’s also more tricky. It’s easy because you handle the dog owner exclusively. Both you and the dog owner write the borrowed funds words.

It is problematic since if you do not purchase it, there isn’t any title installment loans Nashville Ohio evaluate to ensure the house are without one liens.

Likely youre together with guilty of recording the fresh new deed at courthouse to be sure you buy is safely filed. In most cases a genuine estate attorneys otherwise closure agent manages this.

Conclusion

If you’d like to become familiar with a property, including committing to price a home, there’s no an additional capable to teach you than simply Ted Thomas, America’s leading expert into the taxation lien licenses and you will taxation defaulted possessions investing.

Ted Thomas ‘s the one who provides complete assistance and you will done degree with house study courses, Q&A beneficial webinars, live training, workshops & websites kinds, and personal you to definitely-on-that instructions.

If you want to know how to purchase land to own ten, 20, otherwise 31 cents for the dollar, or secure rates off sixteen%, 18%, up to 36%, safeguarded because of the real estate, then start off now with the Totally free Learn Group.

Ted Thomas are America’s Leading Expert to the Taxation Lien Permits and you can Income tax Deed Deals, and additionally a publisher and you may composer of more than 29 instructions. Their guidebooks for the A residential property have purchased in four edges regarding the country. He has started practise somebody as if you for over 29 age how to buy house within the a neighborhoods having cents towards the newest dollar. The guy instructs how to make wide range having minimal exposure and easy-to-see tips.

Comments

Comments are closed.